- “Well over €10 billion” has already been poured into BMW’s Neue Klasse program—described as the biggest single investment in company history. Bloomberg

- Debrecen, Hungary: BMW’s brand‑new plant officially opened September 29, 2025; it’s the first BMW car factory to run on renewable electricity in normal operation (no fossil fuels). Series production of the new iX3 (first Neue Klasse model) starts late October 2025. BMW Group

- Investment in the Debrecen site and on‑site high‑voltage battery assembly: >€2 billion by end‑2025; the factory is designed for ~150,000 vehicles/year at full run‑rate. BMW Group

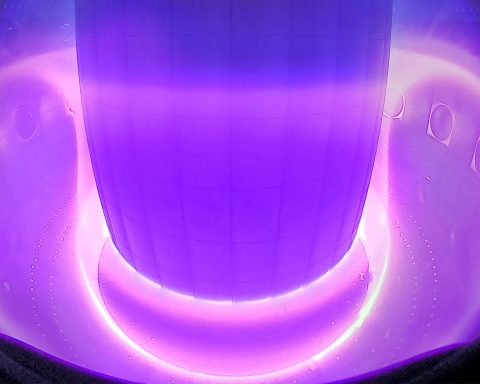

- Next‑gen cylindrical Gen6 cells (46‑mm class) debut with Neue Klasse: +20% energy density, +30% faster charging, up to +30% range vs. current BMW EVs; battery costs targeted 40–50% lower. BMW’s stated goal: EV manufacturing costs on par with modern ICE. BMW Group

- CATL gigafactory, Debrecen (≈100 GWh, €7.3 billion investment) will supply European OEMs and is slated to begin output late‑2025/early‑2026—right next door to BMW’s plant. Reuters

- BMW has multi‑year, double‑digit‑billion‑euro cell‑supply deals with CATL and EVE for the Neue Klasse rollout, including in Europe. BMW Group

- Corporate firepower behind the pivot: >€18 billion in R&D and capex tied to future products and facilities in 2024 alone. BMW Group

- Strategic aim: regain growth in China with Neue Klasse and restore margins, amid fierce competition from local EV champions. Reuters

In‑depth analysis

1) The €10 billion bet: BMW’s biggest reinvention in decades

BMW’s Neue Klasse isn’t a single model—it’s an all‑new EV platform, electronics architecture, and manufacturing playbook that the company has already funded to the tune of “well over €10 billion.” That spend covers vehicle development, software and compute (“super‑brains”), and the global production reset needed to build these cars at scale. The scale of the outlay—and the message from Munich—is clear: Neue Klasse is the spearhead for winning back share from Tesla and Chinese EV heavyweights. Bloomberg

Backing that bet, BMW disclosed it plowed more than €18 billion into R&D and capital expenditure in 2024, explicitly linked to new products and facilities such as the Debrecen plant and multiple battery assembly sites. BMW Group

2) Debrecen: a purpose‑built, fossil‑free EV plant—opened September 2025

BMW cut the ribbon on Plant Debrecen on September 29, 2025. It’s the company’s first car factory to run entirely on renewable electricity during normal operation, even in energy‑hungry areas like the paint shop. Series production of the iX3—the first Neue Klasse vehicle—begins late October 2025. BMW Group

BMW has committed over €2 billion by end‑2025 to the site and its on‑site high‑voltage battery assembly. The facility is engineered for ~150,000 vehicles/year at maturity, with volumes ramping in stages after SOP. BMW Group

3) Why the site matters: located beside Europe’s next battery behemoth

Debrecen isn’t just a car plant—it’s a supply‑chain node. CATL is spending €7.3 billion to install a 100 GWh battery cell factory in the same city, with output slated to begin late‑2025 or early‑2026. That co‑location matters: it shortens supply lines, reduces logistics costs and inventory buffers, and tightens quality loops between cell supplier and pack/vehicle lines. BMW is also assembling Gen6 high‑voltage packs on site, further compressing the chain. Reuters

BMW has said explicitly it is localizing HV‑battery pack assembly in Debrecen to “significantly reduce supply‑chain distances” and logistics costs—the very productivity levers you need to price EVs more aggressively. Automotive Logistics

4) The tech swing: Gen6 round cells to close the price–range gap

Neue Klasse debuts cylindrical (46‑mm class) cells on an 800‑V backbone. BMW’s official performance deltas versus its current EVs:

- >20% higher energy density

- Up to 30% faster DC charging

- Up to 30% more driving range

- ~40–50% lower battery cost at pack level

Crucially, BMW states its goal is EV manufacturing cost parity with contemporary ICE—the threshold that makes mass‑market pricing feasible. BMW Group

BMW has also locked in multi‑year, double‑digit‑billion‑euro cell‑supply commitments with CATL and EVE, including European plants, to ensure capacity and price leverage as volumes scale. BMW Group

Bottom line: pair fewer logistics miles (CATL next door + on‑site pack assembly) with cheaper, denser Gen6 cells, and the path to materially lower EV build costs is credible. That’s the blueprint for competing head‑to‑head with Chinese brands on both price and specs. Reuters

5) “Range of combustion engines”? What BMW is actually promising

“Range like an ICE” is a moving target—many ICE sedans/SUVs run 600–800 km per tank depending on size. BMW’s official promise is up to 30% more range versus its current EVs thanks to Gen6 cells and the 800‑V platform, plus faster charging that shrinks total trip time. The company explicitly ties these gains to cost parity ambitions with ICE. Taken together, BMW aims to deliver ICE‑like ownership utility (range + refueling time proxy) without ICE running costs or emissions. BMW Group

6) Product cadence and the China objective

BMW plans an aggressive roll‑out: iX3 from Debrecen now, a sporty sedan in 2026, and “more than 40 launches” of all drivetrains by 2027. The goal is explicit: get back to growth in China as Neue Klasse volumes become available, after a tough 1H‑2025 in the face of intense local EV competition. BMW Group

7) Competitive lens: taking on China’s efficiency machine

China’s leading EV makers (BYD, et al.) built their edge on battery cost control, vertical integration, and blistering development cycles. BMW’s counter is to collocate with top‑tier cell suppliers (CATL/EVE), compress logistics, and standardize a global Gen6 cell format across six partner‑run gigafactories (two in Europe, two in China, two in North America) to secure scale economics. If Debrecen’s model proves out, it gives BMW European‑made EVs with shorter, cheaper supply chains—a direct answer to the cost/performance playbooks coming out of Shenzhen and Shanghai. BMW Group

8) Risks and watch‑outs

- Ramp execution: New plant + new platform + new cells is a classic “triple‑whammy” ramp; timing hiccups at CATL’s Debrecen site (production late‑2025/early‑2026) would ripple into BMW’s volume plans. Reuters

- Market headwinds: EV demand in Europe has been choppy and margins face pressure from tariffs and pricing wars; BMW has acknowledged margin pressure and is targeting recovery as Neue Klasse scales. Reuters

- Supplier concentration: Heavy reliance on Asian cell partners remains a strategic exposure, although BMW has diversified across CATL and EVE and is adding multiple regional factories. BMW Group

The takeaway

BMW’s Neue Klasse is a systems‑level wager: new cells, new electronics, new software, and a new way of building cars—starting at a renewables‑powered plant in Hungary that sits next to Europe’s largest planned cell factory. The €10‑billion‑plus spend is aimed squarely at out‑executing China’s EV juggernauts on cost and everyday usability (range + charging speed), rather than chasing halo numbers. If Debrecen’s “short supply chain + Gen6” formula scales as planned, BMW will have a credible path to price‑competitive, long‑range EVs made in Europe—and a real shot at reclaiming share in China and beyond. BMW Group