- Lilium’s insolvency filings (Oct 24, 2024 → Feb 21, 2025) highlight the industry’s financing strain and the company’s inability to bridge to certification and service entry. AOPA

- The business plan depended on ultra‑aggressive unit economics: ~$2.25 per passenger‑mile, 4.5 out of 6 seats filled, ~25 flights/day, and ~10 flight hours/day per aircraft. SEC

- Independent analyses put near‑term costs higher than Lilium’s targets and far from mass‑market prices (NASA ~$6.25/PAX‑mi near term; Leeham News ~$2.14/seat‑mi for a best‑case operator). NASA Technical Reports Server

- Batteries remain the hard limit: pack‑level energy density today is ~200–255 Wh/kg in leading packs (CATL Qilin), well below what many designs implicitly assume for long range with reserves. isi.fraunhofer.de

- Lilium’s own SEC materials assumed rapid battery churn (replacement roughly every four months) and ~4.5 pilots per jet—both heavy cost drivers that few headlines covered. SEC

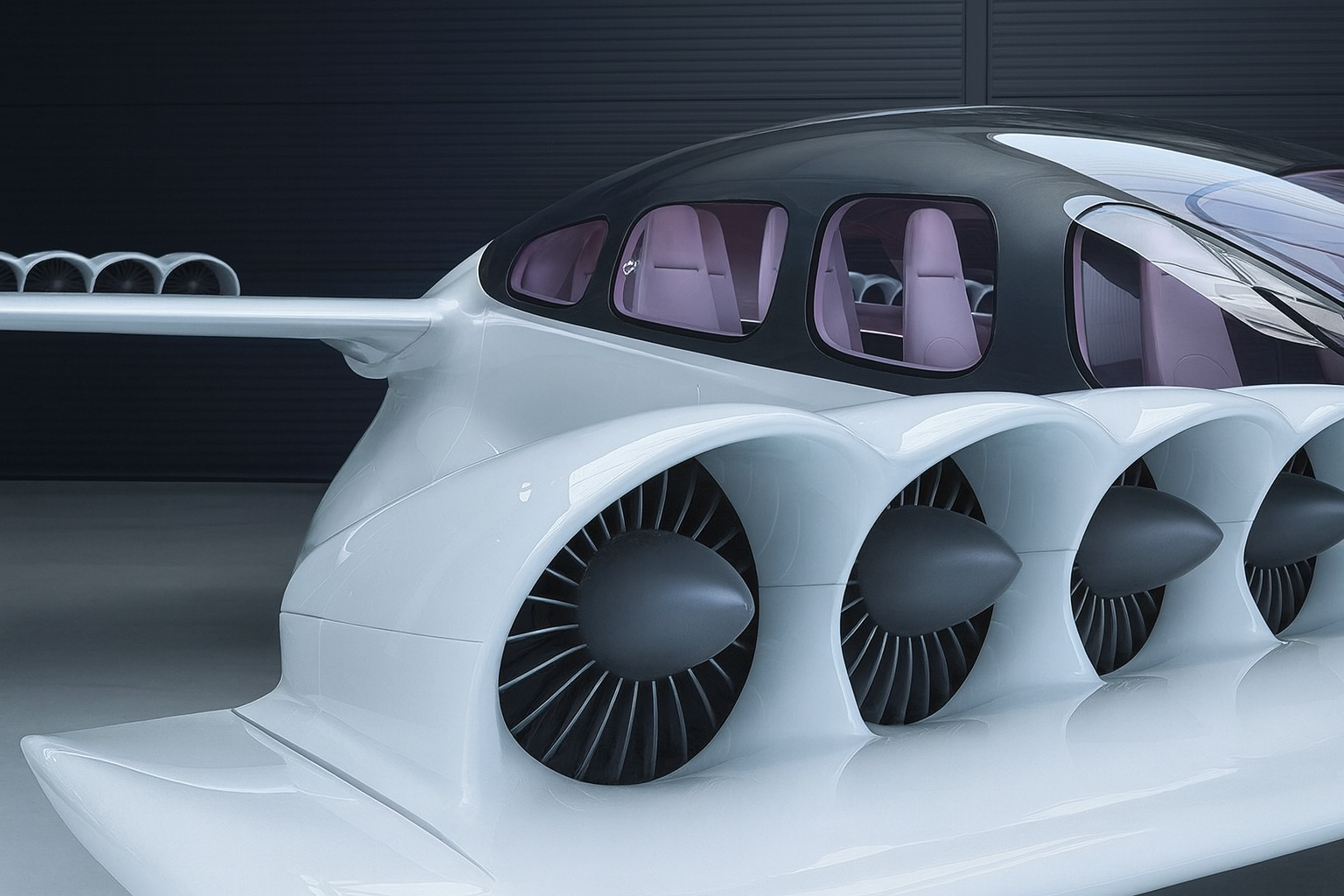

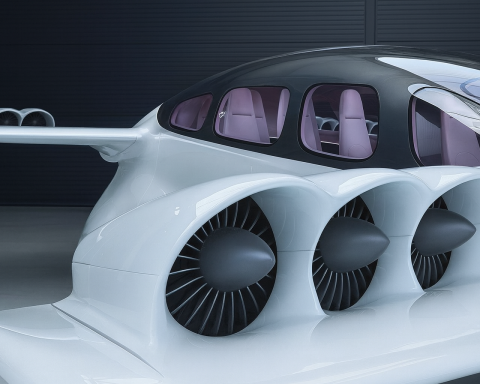

- Ducted, high‑disk‑loading architecture trades cruise drag for very high hover power, amplifying energy and thermal stress during takeoff/landing—the most frequent phases in short‑haul air taxi use. lilium.com

- Certification and rules are still evolving (EASA SC‑VTOL Means of Compliance updates in 2025; FAA vertiport standards are still in “engineering brief” form), complicating timelines and business planning. Federal Aviation Administration

- Vertiport networks are costly to build and run: McKinsey estimates $15–$20M capex and $35–$50M annual opex for a mid‑size city network—before aircraft or operator economics are proven. eVTOL Insights

- Even “promising” early routes need premium pricing (e.g., LAX runs modeled at $2.40–$5.60 per passenger‑mile), limiting demand elasticity. Vertical Mag

- Lilium pivoted Florida infrastructure plans several times (Lake Nona to MCO) but never reached service; by early 2025 its insolvency underscored the gap between plans and execution. Aerospace America

1) What Lilium promised—and what actually happened

From 2021 onward, Lilium pitched a premium regional air‑mobility network using a six‑passenger, one‑pilot “electric jet” and set public expectations for ~$2.25 per passenger‑mile pricing as early as mid‑decade. The plan assumed four‑and‑a‑half seats filled per trip, ~25 flights/day, and ~10 flight hours/day per aircraft—utilization levels typically associated with long‑haul airliners, not short‑hop VTOL shuttles. SEC

On the ground, financing, technology, and certification pressures mounted. Lilium delayed key milestones (e.g., manned flight) and, by October 2024, its German subsidiaries entered self‑administration; February 21, 2025 saw a final insolvency filing when new money failed to arrive. The case has become the industry’s most visible reminder that capital intensity + schedule risk can outlast investor patience. Aviation Week

2) The unit‑economics hurdle: price, load factor, and utilization

At Lilium’s $2.25/PAX‑mile and a typical 60‑mile hop, each flight would gross about $607 with 4.5 passengers. Hitting $15,000/day per jet depends on near‑perfect throughput, quick turns, and steady demand—all while paying pilots, batteries, landing fees, maintenance, and debt service. Lilium’s own investor materials further assumed battery replacements “every ~4 months” and ~4.5 pilots per aircraft per year, both of which inflate operating cost and complexity. SEC

Third‑party estimates are less forgiving: NASA’s UAM market study pointed to a near‑term cost of about $6.25 per passenger‑mile for 5‑seat eVTOLs, while Leeham News modeling suggested ~$2.14 per seat‑mile even under favorable assumptions—above Lilium’s self‑published targets and scarcely mass‑market. NASA Technical Reports Server

Aviation Week went further, questioning the practicality of 10 hours/day utilization on short stage lengths and flagging that Lilium’s plan echoed DayJet‑like regional ambitions—a model that already failed with jets that were cheaper to operate per cycle. Aviation Week

3) Physics doesn’t scale with a slide deck: batteries, power, and heat

Battery pack energy density is the hard ceiling on range, payload, reserves, and cycle life. Real‑world, pack‑level densities in high‑performance systems are around ~200–255 Wh/kg today (e.g., CATL Qilin pack ~255 Wh/kg), whereas many long‑range projections implicitly need higher pack‑level values once you add structure, thermal management, and certification margins. Even cell‑level breakthroughs (e.g., Ionblox ~315 Wh/kg cells) degrade when integrated into aviation‑grade packs and cycled at the high C‑rates eVTOL hover and climb demand. isi.fraunhofer.de

Lilium’s ducted, electric‑vectored‑thrust concept further raises hover power due to high disk loading, a trade it makes for cleaner cruise aerodynamics on longer legs. That trade is least favorable in short‑haul air‑taxi use, where a larger share of each mission is spent in takeoff/landing and transition at high power. Independent technical commentary estimates hover energy consumption orders of magnitude higher than cruise—the exact opposite of what a short‑stage, high‑cycle business needs. lilium.com

4) Battery life and replacement economics

Frequent high‑power cycles at hot temperatures shorten battery life and drive replacement cadence—which Lilium’s own SEC filing effectively acknowledged with “battery replacements: every 4 months.” Even with optimistic learning curves, aviation‑qualified packs cost far more than automotive packs on a per‑kWh basis, and the residual value of heavily cycled, high‑stress packs is uncertain. Academic cost models typically assume $150–$200/kWh for new packs and only partial recovery on second life—costs that dominate direct operating expense when you cycle packs multiple times per day. SEC

5) Infrastructure: vertiports aren’t free—and they aren’t ready everywhere

FAA vertiport design remains in Engineering Brief (EB‑105/105A) rather than a fully baked Advisory Circular; local siting, environmental review, and community acceptance add time and cost. Meanwhile, McKinsey’s city‑scale modeling pegs mid‑size networks at $15–$20M capex and $35–$50M annual opex, meaning the ground system alone demands high, sustained throughput and premium fares from day one. These are not incidental line items; they are existential to margins. NBAA

6) Certification and noise: moving targets

EASA’s Special Condition—VTOL and its Means of Compliance are still being iterated (additional issues in July 2025), and regulators are sharpening noise expectations for VTOL overflight, approach, and departures—areas where community tolerance can make or break network density. In practice, that uncertainty feeds back into financing and rollout schedules, raising the hurdle rate for any operator’s business case. EASA

Lilium has publicized ~60 dBA at 100 m hover noise, but regulatory baselines and real‑world spectral content (tonal components, low‑frequency annoyance) remain under active scrutiny. If required separation distances grow to satisfy communities, vertiport placement becomes harder and trip times/last‑mile costs rise. lilium.com

7) Demand reality: early “airport shuttle” niches need premium pricing

Modeling for Los Angeles–LAX shuttle traffic shows $2.40–$5.60/PAX‑mile pricing to carve out meaningful share—premium relative to ride‑hail and far above public transit. NASA’s market work likewise concludes widespread profitable air‑taxi use is unlikely near‑term, with viability limited to niche, high‑willingness‑to‑pay corridors. Neither picture supports a mass‑market air‑taxi thesis at Lilium’s proposed price band. Vertical Mag

8) Florida as a case study: momentum without milestones

Florida was Lilium’s flagship U.S. region, shifting from Lake Nona to Orlando International (MCO) as the intended hub. Yet by the time insolvency arrived, no commercial service had materialized, and the infrastructure story remained press‑release‑heavy but throughput‑light—a familiar pattern in AAM. Aerospace America

Bottom line: Why the Lilium Jet business case didn’t (and still doesn’t) pencil

Even if one grants Lilium’s technology path and optimistic certification timing, the economic stack is unforgiving:

- Price: $2.25/PAX‑mi depends on premium demand at high load factors. Evidence suggests higher near‑term costs, not lower. NASA Technical Reports Server

- Utilization: 10 flight hours/day on short legs with pilot duty limits, weather, and charging constraints is heroic—and the model breaks if you miss it. Aviation Week

- Batteries: Today’s pack‑level densities and cycle lives force frequent replacements and constrain range with reserves, undermining margins and schedule reliability. isi.fraunhofer.de

- Architecture: High‑disk‑loading ducted fans push hover power and thermal stress up precisely where air‑taxi operations spend a disproportionate share of time. lilium.com

- Infrastructure & rules: Vertiports and noise/certification frameworks remain costly and still evolving, injecting delay and uncertainty into any scale‑up plan. eVTOL Insights

Lilium’s insolvency does not prove eVTOLs can never work—but it does demonstrate that, under 2025 realities, the air‑taxi business case (especially with a ducted‑fan, long‑range architecture) is not viable without breakthroughs in pack‑level energy density, battery life at high C‑rate, automation (to cut pilot cost), mature vertiport networks, and stable certification/noise regimes. Until those arrive, sustained profitability looks like wishful accounting, not a near‑term outcome. EASA

What to watch next (signals that could change the answer)

- Pack‑level batteries ≥300–350 Wh/kg with proven cycle life at frequent fast‑charge; otherwise, range/reserves/cycle‑life math won’t move. isi.fraunhofer.de

- Noise rules finalized with predictable footprints that allow downtown siting without large setbacks. EASA

- From brief to standard: FAA vertiport guidance graduating from EB‑105A to durable, fundable standards—and cities actually funding pads at scale. Federal Aviation Administration

- Automation/ops advances that safely reduce pilot cost per seat and raise allowable utilization without eroding safety. (Regulators began harmonizing powered‑lift guidance in 2024, but ops rules will take time.) eVTOL News

Until then, Lilium’s fall is less an outlier than a forecast: eVTOL air taxis remain a capex‑heavy, battery‑constrained, regulation‑sensitive bet whose economics don’t yet clear the bar for broad urban service. Reuters

Sources

Aviation Week; AIN; Leeham News; NASA UAM studies; EASA SC‑VTOL MOCs; FAA EB‑105A; McKinsey infrastructure estimates; Lilium SEC/Investor materials and press releases; FlightGlobal, Reuters coverage of Lilium’s insolvency and restructuring. GlobeNewswire, Aviation Week, Aviation International News