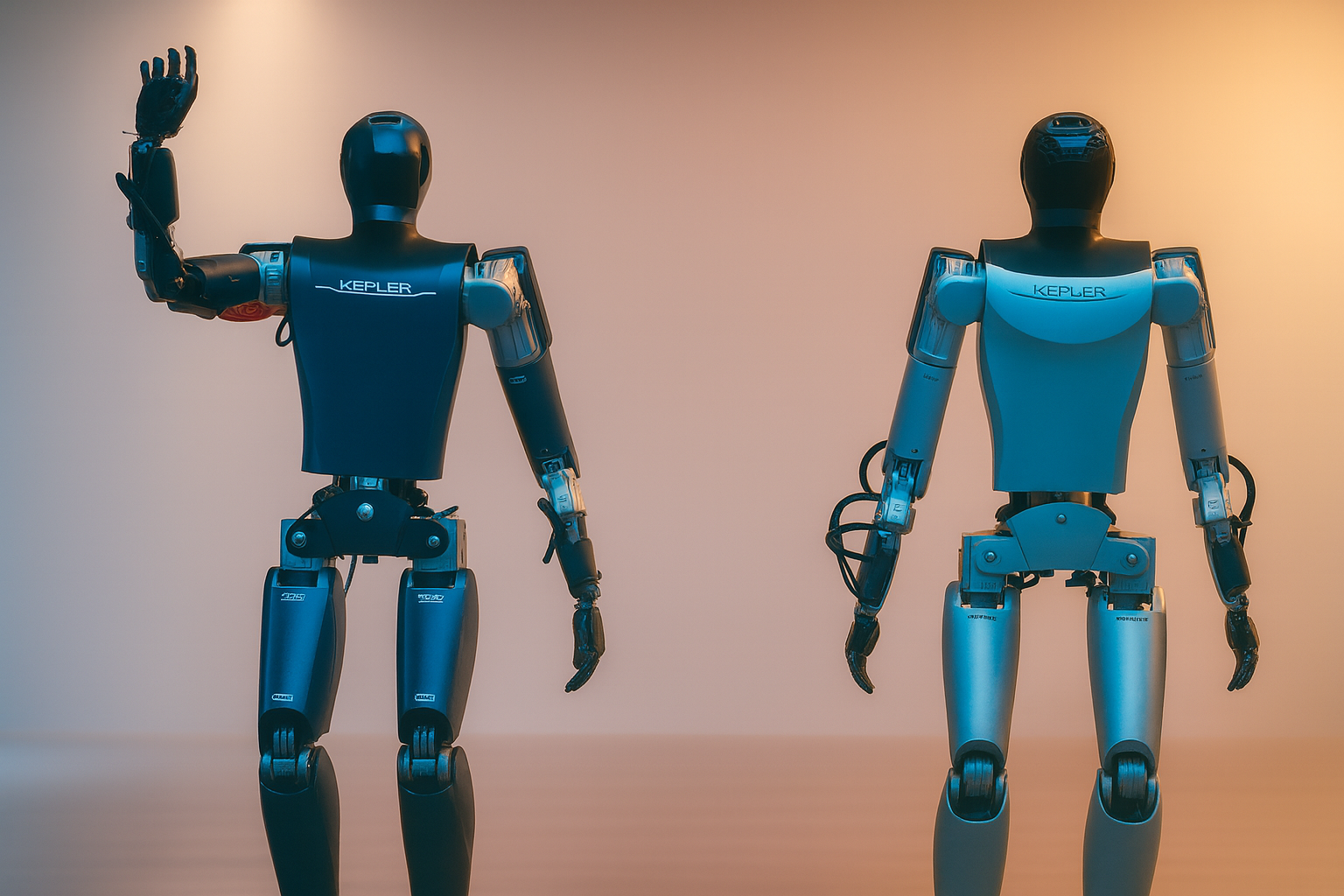

- What happened: Shanghai Kepler Robot Co., Ltd. announced it has begun mass production of its K2 “Bumblebee” humanoid robot and says units have started shipping to customers. PR Newswire

- Price: RMB 248,000 per unit (≈ US$34,000), markedly below the million‑yuan prototypes that dominated early pilots. PR Newswire

- Architecture: “Hybrid” actuation marrying planetary roller‑screw linear actuators with rotary actuators—pitched as yielding human‑like straight‑knee gait, longevity and high torque. PR Newswire

- Specs & endurance: ~175 cm, 75 kg, 52 DoF, 30 kg dual‑arm payload, up to 8 hours per charge (company data, demonstrated in an 8‑hour WAIC livestream). PR Newswire

- Commercial traction (company‑claimed): Framework agreements covering “several thousand” units; contract value in the hundreds of millions of yuan. Volume capacity undisclosed. PR Newswire

- Real‑world pilots: K2 was piloted on an SAIC‑GM automotive line and demoed publicly at ICRA 2025. Interesting Engineering

- Industry context: Analysts see China’s supply chain giving it a cost edge as multiple makers move toward mass production in 2025. Reuters

A new price point—and a public claim of “mass production”

Kepler’s Friday release frames the K2 “Bumblebee” as the “world’s first commercially available hybrid‑architecture humanoid” and, crucially, says the robot is now rolling off a production line and shipping. Priced at RMB 248,000 (about US$34k), the K2 undercuts many Western prototypes and even recent Chinese pilots. Kepler also touts 81.3% energy efficiency, an 8‑hour shift on one charge, and a 30 kg dual‑arm payload for tasks such as tote handling, kitting, and light assembly. PR Newswire

While the company uses the phrase “mass production,” it has not disclosed monthly output or yield; instead it points to framework agreements for “several thousand” units. That nuance matters: framework deals signal intent but are not identical to firm, scheduled purchase orders. Independent coverage largely reiterates the press release, including the price and positioning. PR Newswire

Why the architecture is different

Kepler’s headline technical choice is a hybrid serial‑parallel actuation stack: planetary roller‑screw linear actuators where high load and stiffness are needed, paired with rotary actuators elsewhere. The company argues this yields straight‑knee bipedal gait (closer to human biomechanics) while improving precision and service life versus quasi‑direct‑drive‑only layouts—backed by extensive sim‑to‑real RL and imitation‑learning training for gait stability and energy efficiency. The claim is ambitious and, if borne out in field deployments, could be a meaningful differentiator for uptime and wear. PR Newswire

Kepler previewed the endurance narrative at WAIC 2025, where K2 completed a continuous 8‑hour livestream across logistics and light‑manufacturing scenarios (the firm’s own demo). The spec card it published there also pegged K2 at ~175 cm, 75 kg, and 52 DoF—consistent with what it’s now taking into production. PR Newswire

What experts are saying

- Hu Debo (Kepler CEO) on target use‑cases and duty cycle: “K2 is specifically designed to handle factory work… [with] an eight‑hour work cycle on a one‑hour charge.” He also argued that, at the US$30,000 base level discussed earlier this year, ROI could land within 1.5–1.8 years for simple repetitive tasks in China’s Yangtze River Delta. (Note: today’s production release lists RMB 248,000; configurations and FX can explain the spread.) ehangzhou.gov.cn

- Xu Jun (Head of innovation, Geely/Zeekr) on where humanoids fit first: “Automotive manufacturing is… an ideal environment for humanoid robots.” The sector’s digitalization and standard work patterns make it fertile ground for early adoption. ehangzhou.gov.cn

- Ming Hsun Lee (BoA Securities) on China’s structural advantage: “With its comprehensive supply chain, China has an edge in lowering humanoid robot production cost significantly.” That’s one reason analysts see 1 million humanoids sold globally by 2030 as plausible. Reuters

Proof points so far

Kepler’s K2 has appeared on an automotive line—not just on a trade‑show podium. The robot ran pilots at SAIC‑GM’s Shanghai plant earlier this year, and then performed public demos at ICRA 2025 in Atlanta. These aren’t randomized trials, but they are steps beyond lab videos and scripted stage routines. Interesting Engineering

The market backdrop: a “first year of mass production” in China

Kepler’s announcement lands amid a broader manufacturing push inside China. Central and municipal programs have poured billions into embodied AI, subsidizing data collection, components, and early procurement; multiple domestic humanoid makers say they have entered or are preparing to enter mass production in 2025. In this environment, a US$30k–$35k list price is not a moonshot; Reuters reports bill‑of‑materials could push $35k → $17k by 2030 if sourced largely from China. Reuters

How to read “mass production” right now

- What’s validated: Kepler provides factory‑floor video, eight‑hour runtime demos, and says units are shipping, with thousands in framework agreements. PR Newswire

- What’s still unknown: Throughput, yields, field MTBF, service network density, and after‑sales support are not yet quantified publicly. Watch for named customer case studies with hours‑to‑failure and labor‑savings data rather than trade‑show metrics. (Trade coverage repeats the firm’s numbers almost verbatim.) Robotics & Automation News

Competitive lens

The global race is on: Apptronik (U.S.) raised $350 million this year to scale its Apollo platform; Tesla and Figure continue iterating; inside China, UBTECH, agi, AgiBot and others are also scaling. Kepler’s gambit is to win on cost‑per‑task in industrial/logistics workflows by shipping early, cheap and “good enough”—then compounding with data and iterative hardware. Reuters

Bottom line

Kepler’s move doesn’t prove humanoids are “solved,” but it does move the conversation from show‑floor stunts to priced SKUs that a warehouse or plant manager can line‑item against a real task. The next six to twelve months hinge on repeatable, third‑party‑verified productivity—boxes picked per hour, hours to failure, cost to service. If Kepler’s hybrid architecture and price point hold up in production, it will have forced a new floor under the humanoid market’s economics. PR Newswire

Sources & further reading

- Kepler’s mass production announcement, architecture details, price, and claimed orders. PR Newswire

- Kepler’s 8‑hour endurance livestream at WAIC 2025 (company publication). PR Newswire

- ICRA 2025 third‑party coverage of K2 “Bumblebee.” therobotreport.com

- SAIC‑GM pilot context (trade/tech press). Interesting Engineering

- Industry backdrop—cost curves, subsidy programs, and mass‑production momentum in China. Reuters

- Additional trade coverage summarizing Kepler’s release and pricing. Robotics & Automation News

- Earlier CES 2024 release outlining mass‑production ambitions and target pricing. ces.vporoom.com

Xinhua/municipal outlet report with CEO and industry quotes on duty cycle, ROI, and automotive