The race between lithium iron phosphate (LFP) and nickel–manganese–cobalt (NMC) batteries is heating up as the world shifts to electric vehicles and renewable energy. In this report we compare their chemistries, performance, cost, safety and environmental impact, and how each is being adopted in 2025. We explain the science in clear terms, backed by expert analysis and recent news, to determine which battery chemistry is poised to power the future.

Battery Chemistry & Structure

LFP (Lithium Iron Phosphate): LFP batteries use LiFePO₄ for the cathode and a carbon-based (graphite) anode en.wikipedia.org. The LiFePO₄ has an olivine crystal structure (a 3D phosphate framework) that is very stable. Introduced in the 1990s, LFP’s iron and phosphate are abundant and non-toxic. This polyanion structure makes LFP cathodes inherently safer (less oxygen release under abuse) than cobalt-rich chemistries en.wikipedia.org. LFP cells have a nominal voltage of about 3.2 V (per cell) and tend to release energy steadily.

NMC (Nickel–Manganese–Cobalt Oxide): NMC batteries have layered cathodes made of LiNi_xMn_yCo_zO₂, typically with ratios like 1:1:1 or higher nickel (e.g. NMC811 is 8:1:1) batteryuniversity.com. In each layer, lithium ions intercalate between sheets of nickel, manganese and cobalt oxides. Cobalt improves stability and cycle life but is expensive and scarce. By increasing nickel content, manufacturers boost energy density (range) at the cost of more complex manufacturing and slightly lower stability batteryuniversity.com. NMC cells have a higher nominal voltage (~3.6 V) than LFP.

In summary:

- Composition: LFP = LiFePO₄ (iron + phosphate); NMC = Li(Ni,Mn,Co)O₂ (nickel/manganese/cobalt oxide).

- Structure: LFP’s olivine phosphate structure is very stable. NMC’s layered oxide structure can pack more lithium per volume, boosting energy.

Both use a graphite carbon anode. Advanced versions of each chemistry are emerging (e.g. LMFP – lithium manganese iron phosphate), but in 2025 the core LFP and NMC chemistries dominate the market.

Performance Differences

Battery performance can be compared across key metrics:

- Energy Density: NMC cells hold significantly more energy per weight/volume than LFP en.wikipedia.org, researchgate.net. Typical LFP cells achieve ~150–200 Wh/kg (cell level), whereas top NMC cells reach 250–350 Wh/kg en.wikipedia.org, researchgate.net. In practice, pack-level energy density of LFP is about 20–30% lower by mass (and ~30% lower by volume) than NMC iea.org. This means an NMC-powered car will generally have longer range for the same battery size. Recent innovations have narrowed the gap: e.g. CATL’s latest LFP can now reach ~205 Wh/kg en.wikipedia.org.

- Cycle Life (Lifespan): LFP is famous for longevity. Well-made LFP cells typically last 2,000 cycles or more, often retaining capacity past that researchgate.net, en.wikipedia.org. (Some tests show >3,000 cycles at moderate use en.wikipedia.org.) By contrast, NMC cells typically last on the order of 1,000–2,300 cycles before significant degradation batteryuniversity.com, en.wikipedia.org. In plain terms, LFP packs can be charged and discharged many more times, making them ideal for high-usage or stationary applications.

- Charging & Usable Depth: LFP batteries are tough and can safely be charged to 100% state-of-charge (SOC) without rapid degradation. NMC packs are usually limited to about 80% SOC to protect the battery iea.org. That means an NMC pack may need reserved headroom, whereas LFP can use its full capacity. (However, NMC’s higher energy density still often gives it higher absolute range.) Modern fast-charging tech favors both chemistries. Intriguingly, recent reports show Chinese-made LFP packs charging to add 400–520 km of range in just 5 minutes with ultra-fast chargers climatechangenews.com – a testament to cell and battery-pack innovation.

- Power & Temperature Performance: LFP cells are very stable at high charge/discharge rates and can handle heavy currents (often rated for 2–3C or more). They also tolerate high temperature operation (effective up to ~60 °C researchgate.net) thanks to robust chemistry. NMC cells can also be designed for high power, but they have a lower thermal runaway threshold (~210 °C) than LFP (~270 °C) batteryuniversity.com. In practice, NMC packs can heat up more in abuse, whereas LFP tends to heat less and vent less oxygen.

Overall, NMC wins on raw range and pack energy, while LFP wins on durability, deep discharge use, and thermal headroom. One battery expert notes that LFP is “recommended for applications requiring long lifetimes,” whereas “NMC is ideal when high power is needed” researchgate.net.

Cost Breakdown

Cost is a critical factor as EV adoption scales. Key cost components include raw materials, cell production, and system-level differences:

- Materials Cost: LFP’s ingredients (iron, phosphate) are cheap and abundant. NMC relies on expensive nickel and cobalt. Cobalt especially has seen supply constraints and high prices. Industry analysis finds that LFP cells can be roughly 20–30% cheaper per kWh than comparable NMC cells iea.org, researchgate.net. (An IEA report notes LFP is almost 30% cheaper per kWh than NMC iea.org.) A DOE study (2020) found utility-scale LFP battery systems cost about 6% less per kWh than NMC systems, and LFP cells last ~67% longer en.wikipedia.org.

- Cell & Pack Production: Mass production has driven costs down for both chemistries, but differences remain. Recently battery prices have fallen into the low triple digits per kWh. For example, average LFP cell prices dropped to ≈$100/kWh by 2023 en.wikipedia.org (with some industry reports as low as $56/kWh for large purchases en.wikipedia.org). McKinsey estimates that an NMC cell cost is still about 20% higher than an LFP cell on a per-kWh basis mckinsey.com. As volumes rise, automakers are securing cheaper LFP cells from China (e.g. Ford buys at ~$56–70/kWh en.wikipedia.org).

- Total Ownership: Because LFP packs last longer, their effective cost per usable kWh over the battery lifetime is even lower. Longer life means fewer replacements. Also, LFP battery packs may need simpler cooling or management systems (since they run cooler), slightly reducing ancillary costs. In contrast, higher energy density NMC packs can allow smaller (lighter) systems for the same range, which has its own value. Overall, analysts emphasize that LFP’s lower material cost and longer life give it a clear cost advantage for many uses researchgate.net, en.wikipedia.org.

Safety and Environmental Impact

Fire & Abuse Safety: Safety experts report that LFP batteries are much more stable under stress. For example, in fire testing, NMC cells tend to undergo violent thermal runaway, whereas LFP cells release heat more slowly and far less violently techxplore.com, en.wikipedia.org. A recent analysis found NMC packs produce dramatically higher heat release rates in large fires, especially at high charge, compared to LFP’s relatively steady release techxplore.com. In practical terms, LFP’s strong P–O bonds mean it “harder to ignite” and it “does not decompose at high temperatures” as easily en.wikipedia.org.

“LFP batteries are extremely safe,” says Lars Bacher, CEO of LFP maker Morrow Batteries. He notes that LFP cells have even been tested by embedding nails or setting them on fire – and they did not catch fire climatechangenews.com. In contrast, NMC chemistry is more prone to thermal runaway (rapid fire) under fault conditions techxplore.com.

Environmental & Ethical Impact: LFP has a strong environmental edge because it contains no cobalt or nickel – minerals often linked to mining controversies. Most cobalt is mined in the Congo under harsh conditions, and nickel mines in Indonesia have caused deforestation climatechangenews.com. By contrast, LFP’s iron and phosphorus are abundant and not ecologically sensitive. NGOs cheer this shift: Perrine Fournier of the Fern environmental group calls LFP’s rise “good news for the world’s forests,” since iron/phosphorus aren’t sourced from tropical rainforests climatechangenews.com. Studies even estimate that if all EVs switched to LFP, global deforestation linked to mining could fall by 43% by 2050 climatechangenews.com.

Additionally, LFP’s chemistry poses lower toxicity risk: it is non-toxic and doesn’t rely on cobalt, reducing ethical mining concerns. NMC’s cobalt/nickel demand raises human-rights and environmental issues in mining regions. On recycling, both batteries face challenges, but industry rules (e.g. new EU recycling mandates) are forcing higher material recovery from all battery types environment.ec.europa.eu. Notably, the EU now requires at least 65% recovery of lithium by 2025 (rising to 70% by 2030) environment.ec.europa.eu, affecting how both LFP and NMC packs are recycled.

Primary Use Cases

- Electric Vehicles (EVs): High-range or premium EVs typically use NMC batteries. NMC’s energy density makes it the “preferred candidate” for long-range cars and performance vehicles batteryuniversity.com. For example, Tesla’s long-range Model 3 and Model Y use NMC cells to hit 600+ km ranges. By contrast, affordable or city EVs increasingly use LFP. Tesla’s standard-range cars (Models 3 SR+ and Y) built after late 2021 switched to LFP cells en.wikipedia.org. Chinese makers like BYD also fit LFP blade batteries in many models. In 2023, both a 73 kWh LFP Tesla and a 101 kWh NMC Tesla were offered – giving ~450 km vs ~630 km range mckinsey.com respectively. In short, NMC still powers vehicles needing maximum range, while LFP serves budget/commuter EVs and short-range models mckinsey.com, batteryuniversity.com.

- Grid and Stationary Storage: LFP is dominant in grid-scale and home storage. Its long cycle life and safety make it ideal for power backup and solar integration en.wikipedia.org, batterytechonline.com. Many residential batteries (Tesla Powerwall 3, Sonnen, etc.) and utility banks now use LFP packs. NMC is less common here due to cost and lifespan disadvantages.

- Consumer Electronics & Industrial: High-energy NMC (and related NCA) cells power most laptops, phones, and power tools, where size/weight matter. LFP’s lower energy density makes it rare in small devices, but it appears in heavy-duty industrial tools or battery-electric buses where robustness is needed.

- Specialty: LFP and NMC are both used in electric buses, bikes and forklifts. Generally, any application prioritizing long life and safety (off-road vehicles, emergency lighting, solar lighting en.wikipedia.org) favors LFP; where light weight and maximum run-time are vital, NMC is chosen. As one study notes, LFP is best for “long lifetimes,” whereas NMC is used when “high power” is required researchgate.net.

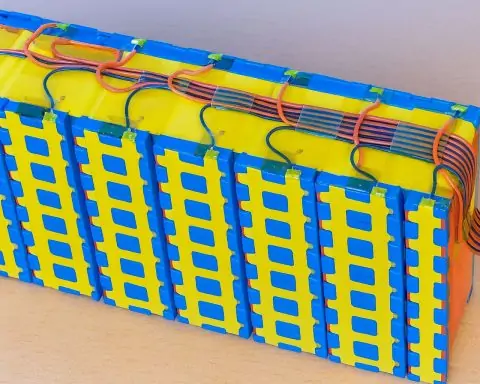

Assembly of LFP battery packs on a factory line. As shown here, LFP cells are now being manufactured at scale (for example by Morrow Batteries in Norway). In EVs like Tesla Model 3/Y, LFP packs are used in all standard-range versions from 2022 onward en.wikipedia.org, while NMC packs are used in higher-range variants and most luxury EVs.

Market Trends (2025)

Global Adoption: LFP’s share of the EV battery market has exploded. In 2020 LFP was under 10%, but by 2024 it reached roughly 50% of all new EV batteries globally climatechangenews.com, iea.org. This shift has been led by China: domestic EVs there use LFP at ~74% penetration iea.org, because of cost and safety. Europe and the U.S. lagged (each around 10% LFP share in 2024) due partly to trade tariffs and late adoption iea.org, mckinsey.com. However, sales of Chinese-imported LFP EVs (like small cars) are rising in Europe. Southeast Asia, Brazil, India – strong EV growth regions – are also favoring LFP, often for budget models.

Policy and Supply Chains: Geopolitics is a factor. The EU and China have pushed local battery rules. Notably, in Nov 2024 China imposed export controls on LFP battery technology iea.org. And in mid-2025, China announced export licenses for core LFP materials (like phosphoric acid) climatechangenews.com, batterytechonline.com, tightening its grip. Meanwhile the U.S. added import tariffs on Chinese batteries; ironically, this made NMC models (often exempt) temporarily more attractive in the U.S. market mckinsey.com.

Manufacturers are responding: Stellantis and CATL announced a joint 50 GWh LFP gigafactory in Spain iea.org, to supply European EVs. In the U.S. and Canada, new startups (e.g. First Phosphate, Ultion Technologies) are developing local LFP supply chains batterytechonline.com. For example, in 2025 First Phosphate produced LFP 18650 cells using only North American minerals batterytechonline.com. As Ultion’s CEO put it: “American innovation can compete head-to-head with any battery technology in the world… We are demonstrating performance that surpasses imports” batterytechonline.com.

Price Trends: Battery prices keep falling. An analysis reports the average cost of lithium-ion packs dropped from ~$137/kWh in 2022 to about $89/kWh in 2025 discoveryalert.com.au. This rapid decline is accelerating EV adoption. LFP cells have driven much of this: by early 2025, large LFP cells were as cheap as ~$50–70/kWh in China en.wikipedia.org. This cost advantage is why “the LFP share is now growing because they are 30% cheaper” climatechangenews.com.

Innovations: Both chemistries continue evolving. Chinese giants CATL and BYD unveiled new fast-charging LFP technologies: CATL’s Shenxing cell adds 520 km range in 5 minutes batterytechonline.com, and BYD claims 400 km in 5 minutes – “fast enough that it makes gas irrelevant” batterytechonline.com. At the same time, NMC is advancing too (single-crystal cathodes, higher nickel blends, solid-state electrolytes on the horizon). Importantly, McKinsey notes that as of 2025 the pack-level energy gap is only 5–20% (much smaller than cell-level) mckinsey.com. This, plus LFP’s cost edge, is tipping OEMs towards LFP for many models. For example, McKinsey projects LFP could reach ~44% of global battery output by 2025 mckinsey.com and that by 2026 most major automakers will offer at least one LFP-equipped model mckinsey.com.

Regulations: In 2025 regulators have pushed battery standards. The EU’s new Battery Regulation requires tracking carbon footprints and achieving high recycling rates. For instance, rules now mandate recycling 65% of lithium from used batteries by 2025 (rising to 70% by 2030) environment.ec.europa.eu. Such measures affect both LFP and NMC industries by incentivizing more material reuse and greener supply chains.

Expert Insights

Industry experts confirm these trends. Perrine Fournier of NGO Fern says LFP’s rise is “good news for the world’s forests,” since it avoids mining cobalt/nickel under sensitive rainforests climatechangenews.com. Morrow Batteries CEO Lars Bacher emphasizes safety: LFP batteries are “extremely safe,” surviving nail-penetration and fire tests without igniting climatechangenews.com. Michael Anderson of Battery Technology reports that China’s export controls on LFP tech target its “lower costs and improved safety profiles” batterytechonline.com. On the North American front, Ultion CEO Johnnie Stoker proudly notes “we can now point to a working battery cell and say every critical material came from North America” batterytechonline.com, showing new supply-chain progress.

Researchers add perspective. A recent battery study found LFP cells easily exceed 2,000 cycles at about 30% lower cost than NMC, and can operate up to 60 °C researchgate.net. It concludes that LFP’s advantages (cost, safety, longevity) make it ideal for mass-market and grid use, while NMC’s superior energy density keeps it vital for high-performance EVs researchgate.net, researchgate.net.

In summary, the “battle” isn’t one-size-fits-all. LFP is winning on cost, durability, and safety – and gaining market share fast. NMC still leads in energy density (range) and is entrenched in premium EVs. As one analyst puts it, LFP suits the “economy and mid-range vehicles” where affordability matters discoveryalert.com.au, whereas NMC remains king of the high-end. By 2025 the trend is clear: LFP is powering a big portion of the EV revolution (nearly half of all new battery capacity iea.org), while NMC continues to innovate for the longest-range needs.

Sources: Industry analyses and news reports (IEA, McKinsey, climate changenews, battery research journals, etc.) were used for data and quotes researchgate.net, iea.org, climatechangenews.com, batterytechonline.com, mckinsey.com.