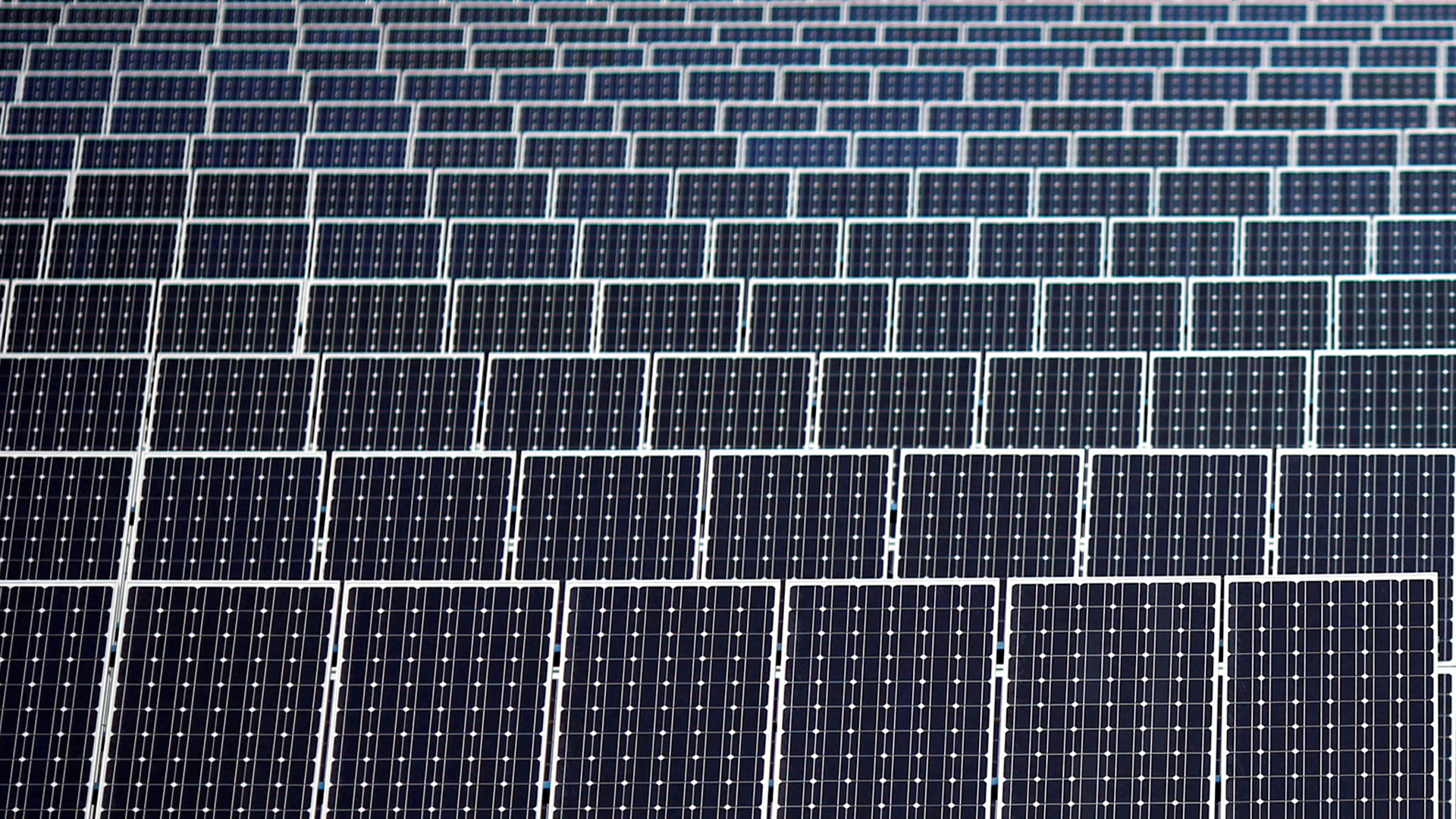

- Chinese manufacturers dominate global solar supply: The top Chinese panel makers delivered record volumes in 2024 (500 GW collectively) pv-tech.org, with JinkoSolar alone shipping ~99.6 GW pv-tech.org. They account for the vast majority of world production, underscoring China’s grip on the solar industry.

- Record efficiencies and high-power panels: Chinese brands are racing to break efficiency limits. JinkoSolar’s new Tiger Neo 3.0 panel hits 24.8% efficiency (495 W) sunsave.energy, while Trina, Risen, Tongwei and others offer 700W+ utility modules at ~24–25% efficiency cleanenergyreviews.info. Most top manufacturers now use advanced n-type cell tech (TOPCon, HJT, back-contact) to push module efficiencies above 23%c leanenergyreviews.info, cleanenergyreviews.info.

- Global price plunge: A fierce price war in 2023–2024 drove module prices to historic lows. By late 2024, Tier-1 Chinese TOPCon modules were selling around $0.08–0.09/W FOB China pv-magazine.com (8–9 cents/Watt) due to oversupply, with delivered prices of ~€0.10/W in Europe pv-magazine.com. Even after slight rebounds in 2025, prices remain far below early-2020s levels, squeezing manufacturer margins pv-tech.org. (In the US, tariffs keep prices higher around $0.28/W pv-magazine.com.)

- Scale and bankability: China’s “Big 4” (JinkoSolar, JA Solar, Trina, LONGi) are globally revered and highly bankable – Jinko and LONGi hold AAA ratings for “exceptional financial stability, global operations, and high-quality products” 7sun.eu. Nearly all top 10 Chinese firms are rated Tier-1 bankable by Bloomberg or PV-Tech, meaning projects using their panels easily secure financing.

- Strengths vs. weaknesses: Top Chinese brands excel in cost (vertically integrated supply chains, economies of scale), innovation (rapid R&D, new cell technologies), and volume (huge capacity). Many offer extended warranties (often ~12–15-year product and 25–30-year performance guarantees at ~87% output) to bolster reliability sunsave.energysunsave.energy. However, intense competition and low prices have eroded profits – China’s four largest manufacturers lost a combined $1.5 billion in H1 2025 pv-tech.org. Oversupply, razor-thin margins, and trade barriers are ongoing challenges even for these industry giants pv-tech.org.

Jinko Solar

JinkoSolar’s automated module assembly lines: the scale of production at a Jinko factory underpins its cost leadership pv-tech.org.

Overview: JinkoSolar is the world’s largest solar panel manufacturer as of 2024, headquartered in Shanghai. Founded in 2006, Jinko has a massive global footprint with 14 manufacturing facilities across China, the US, Malaysia, and Vietnam sunsave.energy. In 2024 it became the first module maker to surpass 210 GW of total shipments sunsave.energy, shipping an industry-record ~99.6 GW in that year alone pv-tech.org. Jinko’s scale and vertical integration (ingot-to-panel) give it cost advantages and resilience. The company has ~57,000 employees and even sponsors international brands (e.g. Manchester City FC) to raise its profile sunsave.energy. Analysts rank Jinko as a top-tier, “AAA”-rated manufacturer with exceptional financial stability and a global presence 7sun.eu. However, like peers, it saw profits pressured by falling prices – Jinko’s revenue fell ~33% in H1 2025, contributing to a net loss of RMB 2.9 billion (≈$400 million) that period pv-tech.org, pv-tech.org.

Flagship Products & Efficiency: JinkoSolar is a technology leader, rapidly adopting n-type TOPCon cells in its flagship Tiger Neo series. The Tiger Neo panels for residential and C&I markets offer module efficiencies up to 23.8% (e.g. a 515 W panel) cleanenergyreviews.info. In late 2024, Jinko launched the Tiger Neo 3.0 which achieves a remarkable 24.8% module efficiency at 495 W output sunsave.energy – one of the highest efficiency ratings for any commercially available panel. For utility-scale projects, Jinko supplies large-format panels exceeding 600 W (using 182mm/210mm wafers and half-cut cells) with high bifacial gains for extra yield. Its latest 72-cell n-type panels reach ~630–670 W with ~22–23% efficiency jasolar.com. Jinko also continues to break lab records (its R&D arm achieved a world-record ~26.4% efficiency for a TOPCon cell in 2023). These advanced products reflect Jinko’s heavy investment in R&D and early move into next-gen cell tech.

Global Market & Price: JinkoSolar’s panels are sold worldwide across residential, commercial, and solar farm segments. It is known for aggressively competitive pricing – a key factor in its #1 shipment rank. During the 2024 glut, Jinko (like peers) slashed ASPs; by Q4 2024, Chinese-made Jinko TOPCon modules were reportedly around $0.09/W FOB pv-magazine.com. Even delivered to Europe, Tier-1 Jinko modules were ~€0.10/W pv-magazine.com, reflecting how Jinko leveraged scale to undercut rivals. This “price war” strategy has boosted Jinko’s market share but at the expense of margins. Still, Jinko’s bankability and global service network let it command slightly higher pricing in premium markets (e.g. for its high-efficiency or bifacial lines) relative to smaller brands. In the US, due to tariffs, Jinko’s utility-scale panels (often shipped from its Malaysia/Vietnam plants to avoid duties) cost around $0.28–$0.30/W as of early 2025 pv-magazine.com.

Strengths:

- Scale & Cost Leadership: Largest production capacity globally, enabling lowest $/W module costs pv-tech.org. Highly automated factories and vertical integration drive economies of scale.

- Technology & Efficiency: Early adopter of TOPCon; consistently high module efficiencies ~23–25% on latest series cleanenergyreviews.info, sunsave.energy. Strong R&D – known for frequent efficiency records.

- Bankability & Quality: Rated AAA for bankability 7sun.eu; highly trusted by banks/EPCs. Offers robust 15-year product warranties and 30-year performance guarantees (87% output) on premium panels sunsave.energy. Global support infrastructure for after-sales.

Weaknesses:

- Thin Margins: Aggressive pricing strategy and polysilicon price volatility have hurt profitability (major losses in late 2024/early 2025) pv-tech.org. Reliance on volume growth to offset low margins is a risk during downturns.

- Trade Policy Exposure: Heavily exposed to tariffs/trade barriers (U.S. AD/CVD, Europe carbon tariffs). Requires overseas factories to serve some markets, adding complexity pv-tech.org.

- High Competition: Faces intense competition from other top Chinese players on technology and price, requiring constant innovation and cost cuts to stay ahead pv-tech.org.

JA Solar

JA Solar’s jumbo-sized “DeepBlue” series panel on display (800 W prototype). JA leverages large-format wafers and n-type cells for higher power and efficiency.

Overview: JA Solar (based in Beijing, founded 2005) is another of China’s solar juggernauts, consistently ranking among the top 3 module suppliers globally. In 2024, JA shipped ~46–50 GW (it was #2 by some rankings) pv-tech.org, sunsave.energy, and in H1 2025 it delivered 33.8 GW of panels pv-tech.org – nearly on par with Trina. JA Solar has a strong international footprint, with sales ~45% overseas (especially in Europe, Asia-Pacific) and manufacturing in China and Southeast Asia. It is known for solid product quality and was ranked the #1 PV module maker by Wood Mackenzie’s 2023 bankability scorecard pv-magazine-usa.com. WoodMac praised JA for its manufacturing experience and technology maturity; JA earned a top score of 82.9/100, reflecting “high reliability and innovation” among the industry leaders pv-magazine-usa.com, 7sun.eu. Financially, JA has weathered the price war but not unscathed – its revenues dropped ~36% in H1 2025 amid low prices, and it posted a net loss of RMB 2.58 billion for that period pv-tech.org. Nonetheless, JA remains a bankable Tier-1 supplier for large projects worldwide.

Products & Technology: JA Solar’s flagship products belong to its DeepBlue series. After the successful p-type DeepBlue 3.0 panels, JA transitioned to n-type with DeepBlue 4.0 X and DeepBlue 4.0 Pro. These modules use JA’s proprietary Bycium+ cells (TOPCon) with mass-produced cell efficiency around 25% jasolar.com. The DeepBlue 4.0 Pro (introduced at SNEC 2023) is a 72-cell module (182×199 mm rectangular wafers) that delivers up to 630 W with 22.5% module efficiency jasolar.com. JA also produces slightly smaller formats for C&I rooftops – e.g. a 66-cell n-type panel (~605 W, 23.4% efficient) made our list of most efficient panels sunsave.energy. On the residential side, JA offers high-performance 54-cell modules (~410–435 W) with 20–21% efficiency in the DeepBlue lineup enfsolar.com. Notably, JA Solar has engineered panels for special environments: it recently launched Desert Blue modules tailored for desert and high-temperature regions (enhanced dust and heat resistance) pv-tech.org. Across its range, JA emphasizes reliability – most panels carry a 12-year (upgradable to 15-year) product warranty and 25–30-year performance warranty (guaranteeing ~87% output at year 30) sunsave.energy.

Global Market & Use Cases: JA Solar serves all market segments: utility-scale farms, commercial installations, and home rooftops. Its modules are often used in large solar farms in China and abroad – for instance, JA has been a key supplier to many 100+ MW projects in Europe and Asia. The company’s strong overseas sales channels have helped it remain profitable in some markets; JA was among the first Chinese OEMs to set up assembly in Vietnam to circumvent U.S. tariffs. In terms of pricing, JA’s panel prices tend to track closely with other Tier-1 Chinese brands. During the 2024 glut, JA modules (like Jinko’s) dipped to the ~$0.20/W range globally (and well under $0.30 in most markets) as the company fought to maintain volume. JA does not significantly premium-price its product, instead banking on its Tier-1 reputation and solid performance-to-cost ratio to win contracts. Its strength in emerging markets (MEA, LATAM) comes from a reputation for robust panels in harsh climates (high hail, wind, PID resistance).

Strengths:

- Technical Innovation: Strong R&D leading to high-efficiency products (TOPCon cells ~25% eff. jasolar.com). Pioneered large rectangular wafers to boost power (DeepBlue 4.0 Pro 630 W). Continuous product improvement for various climates (e.g. Desert module line).

- Bankability & Reliability: Consistently rated Tier-1; ranked #1 by WoodMac for overall manufacturing strength pv-magazine-usa.com. Modules known for durability – e.g. JA offers 30-year performance guarantees ~87% sunsave.energy.

- Global Reach: Extensive distribution in 100+ countries; diversified customer base. Strong presence in Europe and Asia; adept at navigating trade shifts (e.g. using overseas factories to supply the U.S.).

Weaknesses:

- Profitability Pressures: Like peers, JA’s margins have been hit hard by tumbling prices (revenues -36% in H1 2025) pv-tech.org. The need to invest in new tech (n-type) while cutting prices squeezed its short-term profitability.

- Limited Brand Differentiation: Outside of industry circles, JA’s brand is less consumer-facing than some rivals. It lacks the marketing splash of a Trina or global projects of a First Solar, which could matter in residential segments.

- Dependency on Polysilicon Suppliers: JA is not fully vertically integrated upstream (unlike, say, Tongwei). It relies on external polysilicon/wafer inputs, which can be a disadvantage if upstream prices spike (though that risk eased by 2024’s poly glut).

Trina Solar

Overview: Trina Solar (founded 1997 in Changzhou, China) is a pioneering solar manufacturer and one of the industry’s most bankable names. Trina was an early leader in silicon PV and remains in the global top 3 by shipment volume – it shipped around 34 GW in H1 2024 sunsave.energy and ~32 GW in H1 2025 pv-tech.org (over 60 GW for full-year 2024). Trina has a broad international presence, with sales roughly split between China (~50%) and overseas markets (notably Europe ~25%, Asia-Pacific ~12%, Middle East ~8% as of mid-2025) pv-tech.org. The company is credited with spearheading the shift to 210 mm wafers and ultra-high-power modules in 2020–2021, which set industry trends. As of mid-2025, Trina boasts that its cumulative shipments of 210 mm “Vertex” series modules exceeded 200 GW – ranked #1 globally for that large-format category pv-tech.org. Like other top Chinese firms, Trina is considered highly bankable (PV-Tech rates it in the AA tier alongside JA Solar 7sun.eu), and it has an established track record of quality and innovation. Trina has diversified into system solutions (trackers, energy storage), but solar panels remain its core business. Financially, Trina faced the same headwinds of falling ASPs – H1 2025 revenue was down ~28% YoY and it posted a net loss ~RMB 2.9 billion pv-tech.org. Still, Trina’s prudent management and global diversification position it well for recovery as markets stabilize.

Panel Technologies: Trina’s flagship Vertex series panels are available across all segments: small-format Vertex S for rooftops, mid-size Vertex for C&I, and large Vertex (e.g. Vertex N, Vertex 670W) for utility-scale. Trina was among the first to commercialize n-type i-TOPCon cells in mass production. The Vertex N (n-type series) modules reach ~630–690 W in 210mm, 132-cell formats, with efficiencies ~23–24% sunsave.energy. For example, a bifacial Vertex N (210mm, 130-cell) is rated ~630 W at 23.3% efficiency sunsave.energy. Trina also continues to produce p-type PERC panels (Vertex P series) for cost-sensitive markets, but its roadmap is firmly toward n-type. On the residential side, the Vertex S+ (n-type, ~420–500 W) panels hit ~23.0% efficiency cleanenergyreviews.info with sleek all-black aesthetics available. Trina’s innovation includes using 210mm thin wafers, multi-busbar tiling, and a high-density cell interconnect (small gaps) to boost efficiency. Additionally, Trina has introduced specialized modules like the Vertex Super-Factory high-power bifacial and is exploring perovskite tandem technology in R&D. With strong engineering heritage, Trina also optimizes its modules for reliability – e.g. reinforcing frames to handle 6000 Pa snow load and stringent PID resistance for desert installations.

Global Deployment & Pricing: Trina is a favorite supplier for utility-scale projects worldwide. Its large-format Vertex 600–670 W modules have been widely deployed in solar farms in China, India, the Middle East, and Latin America. Trina also gained traction in distributed generation – its Vertex S series is sold by installers in Europe, Australia, and Asia for rooftops. On pricing, Trina generally aligns with other Tier-1 Chinese brands: highly competitive. During 2024’s oversupply, Trina cut prices significantly – its modules could be procured in bulk in Asia at ~$0.20/W or below, and in Europe around $0.22–0.24/W (CIF). Trina did attempt to differentiate slightly on technology; for example, its n-type Vertex N modules initially commanded a small premium (a couple of cents per watt) over older PERC panels due to higher performance. But by 2025, that premium largely eroded as TOPCon became mainstream. Trina’s global strategy of local warehouses and service centers (in Europe, US, India, etc.) adds value for some buyers and can justify marginally higher pricing than lesser-known brands in those markets. Nevertheless, given intense competition, Trina’s prices are essentially on par with Jinko, JA, and LONGi for similar spec panels.

Strengths:

- Pioneering Innovation: Led the adoption of 210 mm wafers and ultra-high-power modules, which gave it an early tech edge. Continues to innovate in module design (multi-busbar, high-density packing) and new cell tech (e.g. n-type TOPCon, perovskite R&D).

- Project Track Record: Extensive portfolio of successful installations worldwide, from 100 MW solar farms to countless rooftop systems. This proven track record underpins a strong reputation for reliability and performance in the field.

- Integrated Solutions: Beyond panels, Trina offers trackers (via TrinaTracker) and energy storage, providing one-stop solutions for utility projects. This broadens its appeal and revenue streams beyond just module sales.

Weaknesses:

- Profit Margin Erosion: Heavy involvement in the utility segment (which is extremely price-sensitive) means Trina has been caught in the price war, compressing margins. Its recent financial losses pv-tech.org highlight a vulnerability to commodity price swings and aggressive competitors.

- Manufacturing Overcapacity: Trina, like peers, expanded capacity rapidly. In a soft demand cycle, excess capacity can become a burden (low utilization, idle lines) if not managed, impacting cost structure.

- Geopolitical/Trade Risks: While diversified, Trina still manufactures primarily in China. Tariffs (e.g. U.S. Section 201, AD/CVD via Southeast Asia) and any future trade restrictions could limit some market access or require additional investment offshore.

LONGi Green Energy (LONGi Solar)

Overview: LONGi is the world’s largest solar wafer producer and one of the top module manufacturers, renowned for its financial strength and technological prowess. Founded in 2000 and based in Xi’an, China, LONGi built its name supplying silicon wafers to the industry, then forward-integrated into cells and modules (LONGi Solar). It has become a solar titan: in 2024 LONGi shipped an estimated ~60+ GW of panels (H1 2025 alone was 39.6 GW shipped pv-tech.org, placing it second only to Jinko). The company’s vertical integration (from polysilicon and wafers to modules) and scale make it one of the lowest-cost producers. LONGi is highly respected by banks – it shares the coveted AAA bankability rating with Jinko, being “recognized as [a] global leader… exceptional financial stability” 7sun.eu. In fact, LONGi is profitable in upstream segments (wafers/cells) which helped buffer its module business. Nonetheless, the late-2024 price crash hit LONGi too: it reported a 15% drop in revenue and a net loss of RMB 2.57 billion in H1 2025 pv-tech.org. Still, with over $12 billion in annual revenue and a Fortune-500 listing via its parent, LONGi remains one of the most financially solid solar manufacturers. It is also very globally active – LONGi has manufacturing in China, Malaysia, etc., and sales offices worldwide.

Technology & Products: LONGi’s module lineup has traditionally been the Hi-MO series. After dominating the PERC era with Hi-MO4 and Hi-MO5 (monocrystalline PERC modules that set performance benchmarks in late 2010s), LONGi has pivoted to new cell architectures. The Hi-MO 6 series (launched 2022) introduced HPBC cells (Hybrid Passivated Back Contact) for high-end residential panels, reaching ~22.8% efficiency in a sleek full-black module. In 2024, LONGi unveiled the Hi-MO 7, which uses next-gen p-type TOPCon cells to push efficiency further while keeping costs down – targeted at large-scale applications. Most recently, LONGi is developing the Hi-MO X10 series, featuring second-gen HPBC 2.0 back-contact cells. A 54-cell Hi-MO X10 “Explorer” module for residential use achieves about 24.0% efficiency (490 W) cleanenergyreviews.info. LONGi even announced an upcoming bifacial EcoLine/ EcoLife module rated up to 25% efficiency (510 W in a slightly larger format) for late 2025, potentially reclaiming the top efficiency spot cleanenergyreviews.info. On the utility side, LONGi offers modules up to 700 W (e.g. Hi-MO 5/6 bifacial variants, 66-cell, using 182mm wafers) and is likely to adopt 210mm in future lines. The company is famous for R&D – it has set multiple world records for cell efficiency (in TOPCon, HJT, and even experimental tandem cells). For instance, LONGi achieved a 26.81% efficiency record for a p-type TOPCon cell (2023) and is actively researching perovskite-silicon tandem cells with lab results above 31%. This R&D strength ensures LONGi’s products remain cutting-edge.

Market & Strategy: LONGi enjoys a diversified market presence. It is a dominant module supplier in China’s massive utility-scale market (winning many state tenders), and also ships extensively to Europe, India, Latin America, and the Middle East. In Europe, LONGi’s Hi-MO series is popular for commercial rooftops and utility projects; in the US, LONGi has avoided some tariffs via its Malaysia plant and supplies utility developers (though not as large a presence as Jinko/Trina due to limited local assembly). LONGi’s pricing strategy is competitive but slightly nuanced: because it leads in wafers and has cost advantages, it often could afford a bit more margin. It sometimes kept prices a cent or two higher than the very lowest in the market to maintain a premium image, especially for its premium HPBC panels. For example, in early 2023 LONGi resisted dropping panel ASPs as fast as others until mid-year. However, by late 2024 even LONGi had to chase the market down to ~$0.20/W and below for bulk sales. The company’s large wafer business also means it sometimes prioritizes profitability in wafers over modules, which can influence strategy (e.g. selling wafers to competitors when module demand is slow).

Strengths:

- Vertical Integration: Controls key upstream inputs (polysilicon through wafers), ensuring supply security and cost control. This integration helped LONGi and Tongwei become the only ones fully spanning polysilicon-to-module in the top rankings pv-magazine-usa.com.

- R&D and Efficiency: Arguably the industry R&D leader – continuously breaking efficiency records and quickly commercializing advanced tech (e.g. back-contact cells). LONGi’s ability to innovate keeps its products at the forefront of performance.

- Financial Robustness: Strong balance sheet and profitable wafer business provide resilience. LONGi’s scale (Fortune Global 500 listed) and bankability mean customers and financiers have high confidence in its longevity and warranty backing sunsave.energy.

Weaknesses:

- Overextension: Rapid expansion in both upstream and downstream can stretch management focus. Balancing wafer sales to others vs. internal module production is a strategic juggling act – missteps could leave either segment underutilized.

- Profit Sensitivity to Module Market: Despite upstream profits, LONGi’s bottom line still depends on module market health; the recent price crash forced it into losses pv-tech.org. High fixed costs from huge factories mean LONGi is reliant on very large volumes to stay profitable.

- Market Politics: LONGi’s dominance in China ties it somewhat to Chinese policy cycles (e.g. end of FiT in 2025 causing domestic rush then potential lull pv-tech.orgpv-tech.org). Also, being a Chinese state-favored company, it could be subject to geopolitical scrutiny abroad (though so far it’s navigated this well).

Tongwei Solar

Overview: Tongwei Solar is a relatively new heavyweight in module manufacturing, leveraging its roots as the world’s largest polysilicon and solar cell producer. Tongwei Co. (based in Chengdu) historically focused on upstream – by 2023 it was the #1 silicon polysilicon maker and a top-3 cell manufacturer globally. In recent years Tongwei expanded aggressively into making its own modules (rather than selling cells to others), and the results are striking: Tongwei’s module shipments jumped to 24.5 GW in H1 2025 pv-tech.org, a 31% YoY increase, after delivering ~18.7 GW in H1 2024 sunsave.energy. This likely puts Tongwei in the top 5 Chinese panel suppliers by 2024 volumes. Notably, Tongwei Solar is the only solar company on the Fortune Global 500 as of 2023 sunsave.energy – thanks to its enormous vertically integrated operations and revenue. Tongwei’s reputation is built on manufacturing excellence (its solar cells are used by many Tier-1 brands) and financial strength. Now that it sells modules under its own brand (often abbreviated TW Solar), it has quickly achieved Tier-1 status. Wood Mackenzie’s criteria ranked Tongwei among the top 10, noting it is one of only two manufacturers “fully integrated from polysilicon to module” pv-magazine-usa.com (the other being Risen). Tongwei’s vertical integration gives it cost advantages, but as a newer entrant to module sales, it is still building its global distribution and brand image. Its profitability remained solid in 2024 due to upstream earnings, though the module price war did impact margins. In H1 2025 Tongwei saw a smaller revenue drop (~7.5% YoY) than peers, but it did post a net loss ~RMB 4.95 billion pv-tech.org – largely stemming from polysilicon price declines.

Panel Characteristics: Tongwei markets both p-type PERC and n-type TOPCon modules, often using the latest cell technology it perfects in-house. Its flagship products are high-power modules in the Terawatt series (for utility) and Stellar series (for DG), though these brand names are less globally recognized. Technically, Tongwei’s panels are on par with other Tier-1s: for example, Tongwei showcased a 700 W TOPCon module in 2023 with ~22–23% efficiency, and it has since improved on that. In fact, large-format Tongwei panels are reported to exceed 24% efficiency in the latest iterations cleanenergyreviews.info. (Clean Energy Review noted several 700W+ utility modules from TW Solar now reach ~24.2–24.8% efficiency, similar to Trina and Risen’s best cleanenergyreviews.info.) For residential and C&I, Tongwei produces 54-cell and 72-cell formats; one example is a 66-cell n-type module (~590 W, ~22.5% efficiency) offered in 2024. Tongwei’s panels leverage multi-busbar and half-cut cell designs, and the company is beginning to incorporate bifacial and tandem (perovskite/silicon) technologies from its research pipeline. Being a dominant cell producer, Tongwei often can implement the latest cell improvements (like tunnel oxide passivation, advanced metallization) faster across its module line. In terms of reliability, Tongwei’s vertical control allows rigorous quality oversight – it touts low degradation and excellent consistency in its modules (helped by using its high-purity polysilicon internally).

Market Expansion: Initially, Tongwei’s module sales were heavily domestic (feeding China’s utility boom). In H1 2025, about 5.1 GW of its 24.5 GW shipments were exported pv-tech.org (~20%), indicating a focus on building international channels. Tongwei is now actively expanding to overseas markets: it has signed supply deals in Europe and Asia, and its inclusion in Bloomberg’s Tier-1 lists has raised confidence among foreign project developers. However, as a newer module brand, it may not yet command the same mindshare as Jinko or Trina in installer networks. To gain market entry, Tongwei has been pricing its modules very competitively, often slightly undercutting established brands (helped by its lower cost structure). This has accelerated its uptake in price-sensitive markets. For example, in Europe 2024, Tongwei modules were offered at a few euro-cents per watt less than top-tier average, to entice distributors. Over time, if Tongwei solidifies its brand, it may aim for more standard pricing.

Strengths:

- Fully Vertically Integrated: Tongwei’s control from polysilicon to cell to module yields cost savings and supply security. It can profit upstream even if module margins are slim, allowing more aggressive module pricing when needed pv-magazine-usa.com.

- Cell Technology Leadership: As the world’s #1 cell producer, Tongwei’s modules benefit from top-notch cell efficiency and quality. It is often first-to-market with new cell tech (e.g. TOPCon, heterojunction pilot lines) which translates to high module performance.

- Financial Scale: Fortune 500–scale revenue and robust balance sheet from its broader business (including fish farming and other divisions) make Tongwei financially stable. Bankability is high given its role as a key supplier to others historically and now a major module player.

Weaknesses:

- Nascent Brand & Channels: Tongwei is newer to selling under its own name; it lacks a long track record of modules in the field under “TW” branding. It is still building distribution partnerships and after-sales support in many regions.

- High Exposure to Commodity Prices: A large portion of Tongwei’s business is polysilicon/cells – volatility in those markets (e.g. polysilicon price crashes) can heavily impact profitability, even if module manufacturing itself is stable.

- Potential Channel Conflict: As a supplier of cells to other panel makers and simultaneously a competitor in modules, Tongwei must manage relationships carefully. Major clients (who buy Tongwei cells) might be hesitant if Tongwei’s module business threatens theirs, which could eventually affect Tongwei’s cell sales strategy.

Risen Energy

Overview: Risen Energy (headquartered in Ningbo, China; founded 1986) was among the first wave of Chinese solar module exporters and has been a steady presence in the top 10 manufacturers over the past decade. Risen is known for its innovation in high-efficiency tech and early moves into heterojunction (HJT) solar panels. In recent years, Risen’s fortunes have been mixed: it shipped a substantial ~14–15 GW in 2022, but 2024–2025 saw a surprising dip. In H1 2025, Risen’s module shipments totaled only 5.66 GW pv-tech.org, a significant decline (53.9% year-on-year revenue drop in its module segment). This drop took Risen out of the very top ranks by volume, signaling challenges such as fierce price competition and possibly slower capacity expansion relative to rivals. However, Risen still retains Tier-1 status and was tied in the WoodMac bankability ranking at an impressive 5th place (with LONGi) in 2023 pv-magazine-usa.com, reflecting strong vertical integration and a history of delivering quality modules. Notably, Risen is one of the only two companies (along with Tongwei) considered fully integrated from polysilicon through modules pv-magazine-usa.com – Risen acquired polysilicon capacity and makes its own wafers/cells, though on a smaller scale than giants. Financially, Risen has been under pressure: it reported net losses in 2024 and H1 2025 (RMB 6.79 billion loss in H1 2025) pv-tech.org, leading to restructuring efforts. Still, industry observers expect Risen to navigate through the downturn – the company stated plans to improve operations and “become one of the earliest to navigate through this industry cycle”, according to its chairman pv-tech.org.

Advanced Products: Risen is a technology-forward manufacturer, best known for its HJT (heterojunction) solar panels branded as “Hyper-ion”. In 2022, Risen grabbed headlines by launching a 700 W heterojunction bifacial panel – one of the first in the world to break the 700 W barrier. The Hyper-ion series uses large 210 mm n-type HJT cells with thin wafers and zero busbar design. These panels reach about 23.3% efficiency at 700–715 W outputs hjtpv.com, and Risen claims up to 24.7% maximum efficiency on its latest 132-cell HJT version (around 767 W) in ideal conditions en.risen.com. HJT technology gives superior temperature coefficient (~ -0.24%/°C) and bifaciality (~90%+), making Hyper-ion modules especially high energy-yield products en.risen.com. Besides HJT, Risen also produces TOPCon and PERC panels. Its mainstream offering for utility in 2024 was the Titan series (PERC or TOPCon, 210mm, ~600 W range). But Risen clearly has focused its differentiation on HJT – in October 2024 it even announced an upgraded Hyper-ion Pro, aiming for even higher power en.risen.com. For rooftop markets, Risen offers 54-cell and 108-half-cell modules in the 400–500 W range with both mono-facial and bifacial options. The company’s panels typically come with 12-year product warranties (extendable to 15) and 30-year performance warranties (≈87% remaining output) aligning with n-type norms. Risen’s early move into HJT also spurred it to invest in perovskite tandem research (to eventually combine with HJT), showing its forward-looking R&D.

Market and Outlook: Risen historically has been strong in Europe, Australia, and emerging markets. It was among the first Chinese brands to enter Eastern Europe and Central Asia markets. The recent shipment decline suggests Risen may have been more impacted by the price crash – possibly because its HJT panels, while high-performance, were costlier to produce and hard to price competitively against cheaper TOPCon modules during the glut. Indeed, HJT production has higher costs (expensive silver paste, etc.), and Risen’s strategy banking on premium HJT may have backfired in a period when buyers prioritized price over efficiency. Thus, Risen likely had to recalibrate pricing; by 2025 it is reportedly offering Hyper-ion panels at very slim margins to stimulate sales. Over the long term, if/when panel prices stabilize or if HJT costs drop (with scale or cheaper materials like copper plating), Risen could regain ground as its tech advantage plays out. Analysts still rank Risen highly for vertical integration and technology – it remains one of China’s innovators. The company’s near-term strategy includes boosting module sales overseas (beyond China’s competitive auctions) and potentially partnering or merging to gain scale.

Strengths:

- Technological Edge: Pioneer in heterojunction panels – gave Risen a head start in next-gen module performance. Its Hyper-ion HJT modules are among the most efficient globally (≥23% efficiency, excellent bifacial gains) hjtpv.com. This positions Risen well if market shifts to favor highest efficiency.

- Vertical Integration: Risen has in-house polysilicon, wafer, cell capacities (though smaller scale), which secured its supply chain. It is one of few doing so through the whole supply chain pv-magazine-usa.com, reducing dependency on external suppliers and enabling better QC.

- Global Experience: Over 15 years of exporting modules; established distribution networks in Europe, Asia-Pacific, and Americas. Risen’s brand, while not as flashy as some, is trusted by many EPCs due to long-term presence and solid field performance of its panels.

Weaknesses:

- Recent Market Share Loss: The sharp drop in shipments in 2024–2025 pv-tech.org indicates challenges (possibly pricing, scaling HJT, or other execution issues). Losing volume can create a negative feedback (less economy of scale, higher unit costs) that Risen must overcome.

- Higher Cost Structure: Risen’s focus on HJT, a tech not yet fully cost-optimized, likely means higher manufacturing costs compared to peers churning out TOPCon. In a low-price environment, this eroded its competitiveness. Unless HJT costs fall, Risen might struggle on price bids.

- Financial Strain: Consecutive losses have strained Risen’s finances; debt levels have risen. While still a going concern, it has less room for error and may need external capital or partnerships to invest in future capacity upgrades or new tech (like larger wafers or tandem cell lines).

Astronergy (Chint Solar)

Overview: Astronergy, also known as Chint Solar, is the solar arm of China’s Chint Group (a major electrical equipment conglomerate). Founded in 2006, Astronergy was actually one of China’s first privately-owned PV module manufacturers and is credited as a “Tier-1” module supplier today. It has re-emerged in the top ranks recently: Astronergy shipped 18.7 GW of modules in H1 2024 sunsave.energy (tie with Tongwei for 5th globally in that period) and similar volume in H2, putting its full-year 2024 shipments around ~35–40 GW. This is a big jump, reflecting expansions and its position as a key supplier in China’s domestic market. Wood Mackenzie’s 2024 rankings placed Astronergy at #6 globally by composite score pv-tech.org, highlighting its strong manufacturing capacity and growing bankability. The company has manufacturing bases in China, Thailand, and Vietnam, and has supplied panels to over 60 countries. Astronergy was an early adopter of thin-film tech in 2008 (in a JV with a German firm), but later focused on crystalline silicon exclusively. It’s now best known for cost-effective, reliable modules used in utility and commercial projects. Astronergy’s parent, Chint, provides financial stability (Chint is a billion-dollar electrical company), which helped Astronergy weather industry cycles. Indeed, Astronergy managed to stay profitable in some recent quarters where peers had losses. For H1 2025, Astronergy’s financials aren’t public like listed companies, but it’s believed to be faring relatively well thanks to domestic demand.

Products: The flagship for Astronergy is its Astro series of PV modules. In particular, the Astro N (n-type TOPCon) series has garnered attention for high efficiency. An Astronergy Astro N7 residential panel (based on TOPCon) was rated at 23.2% efficiency (515 W) and listed among the top 10 most efficient panels of 2025 cleanenergyreviews.info. For utility-scale, Astronergy produces large Astro N bifacial modules in the 600–700 W range (using 210mm, 144 half-cell configurations). It also continues to offer Astro P series (p-type PERC) modules as a budget line, though the trend is shifting to n-type. The Astro series emphasizes durability – e.g. Astronergy advertises reinforced frames that allow up to 5400 Pa snow load and excellent anti-PID performance, appealing for large power plants. Another unique offering is Astronergy’s lightweight modules for specialized uses: they have some products with thinner glass/backsheet to reduce weight (targeting rooftop installations with weight limits). In 2022, Astronergy achieved a world record 23.22% module efficiency for a TOPCon panel in mass production, underlining its tech capability. It is also exploring heterojunction – there were reports Astronergy planned an HJT line – but for now TOPCon is its mainstay. Warranty-wise, Astronergy provides ~12-year product and 30-year performance warranties on most modules, in line with industry norms, and its n-type panels degrade slower (0.4%/year) so guarantee ~87% output at year 30.

Global Projects & Market Position: Astronergy has supplied numerous utility projects, notably in Asia and Europe. For instance, it was a module provider for a 2 GW solar farm in China’s Qinghai province and for various 50–200 MW projects in Germany, Spain, and the Netherlands. Chint/Astronergy also develops solar projects (acting as an IPP/EPC) in some markets, which sometimes use their own panels – this vertical project development channel helps secure demand for Astronergy’s modules. Internationally, Astronergy might not be as high-profile brand as Trina or Jinko, but it competes well on price and Chint’s global offices (for its electrical gear business) help open doors. In Europe, Astronergy modules are often among the most affordable Tier-1 options. For example, in late 2024, Astronergy’s 550 W PERC panels were available at ~€0.20/W in bulk, undercutting some bigger brands by a small margin. The company can do this due to efficient manufacturing and possibly government incentives (some local provinces in China have supported Chint’s expansions). Being part of a larger conglomerate also means Astronergy might accept lower margins on modules to boost Chint’s broader renewable project business.

Strengths:

- Conglomerate Backing: Backed by Chint Group, providing financial support and a global network in electrical equipment. This backing enhances Astronergy’s bankability and staying power even in tough markets.

- Competitive Cost & Quality: Astronergy is known for good quality control with very attractive pricing. It has been identified as a Tier-1 supplier that consistently delivers reliable panels at slightly lower price points, which is a strong value proposition in project tenders.

- Technology Transition: Successfully transitioned from PERC to TOPCon quickly, as evidenced by its Astro N series hitting >23% efficiencies cleanenergyreviews.info. This agility in adopting new tech keeps its product lineup relevant and high-performing.

Weaknesses:

- Brand Visibility: Outside of industry professionals, Astronergy’s brand is less recognized. It often gets overshadowed by higher-profile rivals when vying for branding in residential markets or high-profile projects.

- Limited Upstream Integration: Astronergy is primarily focused on cells/modules, procuring wafers and polysilicon externally (unlike LONGi, Tongwei). This can expose it to upstream price fluctuations and supply risks, although the current surplus has mitigated this issue.

- Project Development Focus: A portion of Astronergy’s sales are tied to Chint’s own solar projects. If that pipeline slows or if the Chinese domestic boom cools, Astronergy will need to further expand third-party sales abroad to avoid any dip in utilization.

GCL System Integration (GCL-SI)

Overview: GCL-SI is the module manufacturing subsidiary of GCL Group, a Chinese energy conglomerate long known as a leading polysilicon producer (GCL-Poly). GCL-SI (founded 2014) grew quickly in the mid-2010s by leveraging its parent’s silicon supply, and while it faced struggles, it remains a significant player. In H1 2024, GCL-SI shipped about 10 GW of panels sunsave.energy, and by H1 2025 it had delivered 14 GW pv-tech.org (showing ~40% growth). This put GCL roughly around the 7th–8th largest Chinese module maker by volume. GCL-SI has a diversified strategy, producing not just panels but also solar system kits and energy storage. However, the company has had financial difficulties; its parent GCL-Poly went through debt restructuring and GCL-SI itself accrued losses. For instance, even as it shipped 10 GW in early 2024, GCL-SI’s parent posted a net loss of $213 million in that half-year sunsave.energy. Nonetheless, with China’s solar boom, GCL-SI has been able to increase shipments and slightly stabilize. It has manufacturing in China and plans for abroad (at one point discussing a factory in Indonesia). WoodMac’s 2024 report did not list GCL in top 10 by score, but industry observers still consider it a Tier-1 supplier by volume. PV-Tech’s bankability pyramid places GCL-SI in the BB category, noting it has operational stability but “limited financial and innovative capabilities compared to industry leaders” 7sun.eu. This suggests that while GCL makes lots of panels, it’s somewhat behind on cutting-edge tech and financially weaker than the top five.

Panel Portfolio: GCL-SI produces a wide range of modules, from standard utility modules to high-efficiency ones. Impressively, GCL has been marketing an ultra-high power panel: the GCL “NH*” series. One model, the GCL NH12/66GDF, is a 720 W giant module with 23.2% efficiency sunsave.energy – making it one of the most powerful panels on the market by wattage. This likely uses 210 mm N-type cells, 132 half-cell layout (66 full cells), and perhaps tiling ribbon tech. That product is squarely aimed at large solar farms seeking to minimize module count. For more common offerings, GCL has 182 mm cell modules around 540–600 W and 210 mm cell modules ~670 W, in both monofacial and bifacial designs. The company has been working on n-type TOPCon cells as well and showcased prototypes exceeding 23% efficiency. Still, a significant portion of its sales may be p-type PERC panels which are slightly lower cost. GCL-SI also diversified into batteries and integrated solar-battery systems, which it often sells alongside panels (especially for residential market packages domestically). In terms of warranties, GCL offers the industry-standard ~12-year product warranty and 25-year performance (for PERC) or 30-year (for n-type) with around 80% (p-type) or 87% (n-type) end power guaranteed.

Market Dynamics: Domestically, GCL-SI benefited from China’s huge demand and its ties to state projects (through GCL’s broader energy connections). Internationally, GCL’s presence is modest; it has exported to Africa, South Asia, and some to Europe, but it hasn’t established a strong global brand. A few years ago, GCL-SI planned to set up assembly in the U.S. and India, but those plans stalled amid financial woes. Now, with improved conditions, it might refocus on overseas markets. Price-wise, GCL often competes on low cost. It can leverage internal polysilicon to lower cost (though GCL-Poly’s older poly plants were high-cost, they’ve since invested in newer fluidized bed reactor tech for cheaper poly). In late 2024, GCL panels were among the cheapest Tier-1 Chinese modules – reports suggested GCL 550W modules sold at or slightly below $0.20/W in bulk deals. Essentially, GCL-SI is a volume-over-margin player: it frequently underbids on price to win orders and keep its lines running. This strategy, however, led to the financial strain it experienced when prices plunged too low. As prices stabilize, GCL-SI’s challenge is to climb back up the value chain (e.g., succeed with its 720W n-type offerings) so it’s not purely selling on lowest price.

Strengths:

- Integrated Background: Having a parent in polysilicon gives GCL-SI potential access to in-house raw materials. This synergy can lower cost when executed properly, and GCL’s long history in solar materials lends technical know-how.

- High-Power Products: GCL has demonstrated capability to produce super high-watt modules (700W+). Its 720W, 23.2% efficient panel is on par with the best in the world sunsave.energy, showcasing that it can innovate in product design and compete technically when needed.

- Volume Producer: GCL-SI can churn out large volumes (it scaled to ~15+ GW/year capacity). For utility projects requiring massive panel quantities at low cost, GCL is often a contender simply by manufacturing scale and willingness to offer aggressive deals.

Weaknesses:

- Financial Instability: GCL’s finances have been shaky. Losses and debt restructuring hurt confidence – in 2021, GCL-SI flirted with default. While it’s muddling through, some banks/developers have residual concern over warranty backing if the company’s health doesn’t improve.

- Lagging Tech and Brand: Compared to peers, GCL hasn’t been at the forefront of solar cell technology transitions. It was slower to adopt n-type; much of its shipment has been standard PERC. Also, its brand lacks the prestige of others; it’s often seen as a “second-tier” choice when top brands are available, unless the price difference is compelling.

- Minimal International Footprint: GCL-SI is heavily reliant on China’s domestic market. Trade issues or a domestic slowdown would disproportionately impact it, as its sales network overseas is not as robust or well-established as the likes of Jinko, Trina, etc.

DMEGC Solar (Hengdian Group)

Overview: DMEGC Solar is a dark-horse success among Chinese panel makers. Part of the Hengdian Group (a large Chinese conglomerate known for magnetic materials and electronics), DMEGC started in solar around 2009 and has steadily scaled up. By 2024, DMEGC Solar saw a leap in its rankings – it was 5th globally in a 2025 module manufacturer ranking solarquarter.com and shipped about 13.4 GW in H1 2025 solarstoragextra.com (up from 8.1 GW in H1 2024 taiyangnews.info). This surge (64% YoY growth) suggests DMEGC’s full-year 2024 shipments were in the ~16–18 GW range and 2025 could be well above 25 GW if trends hold. Uniquely, DMEGC managed to remain profitable during the 2024 downturn – it turned a net profit of RMB 1.02 billion in H1 2025 pv-tech.org, one of the few to do so, thanks to efficient operations and perhaps niche markets. S&P Global (former PV-Tech) even listed DMEGC as a Tier-1 supplier and noted its rapid ascent solarstoragextra.com. On the PV-Tech bankability pyramid, DMEGC is rated BBB, indicating “solid fundamentals” but smaller scale than top peers 7sun.eu. Indeed, DMEGC’s strategy may be more conservative financially, avoiding overexpansion and focusing on profitability. The company is not as famous internationally, but within China it’s respected for high-quality manufacturing (leveraging Hengdian’s precision electronics background). DMEGC’s parent ensures financial backing, and the company has been investing in new cell technology lines to keep up technologically.

Products: DMEGC Solar produces both mono-facial and bifacial mono-crystalline modules, largely based on PERC and now moving into TOPCon. Its product series include the Black Leopard series (high efficiency mono modules for rooftops) and Phantom series (bifacial dual-glass for utility), though these brand names are not widely marketed globally. In terms of specs, DMEGC’s latest modules using 182 mm TOPCon cells reach around 580–600 W with ~22–23% efficiency (in 144 half-cell format). They have also introduced 210 mm based panels ~670 W. While we don’t have a specific hero product spec cited like others, DMEGC’s performance is comparable to Tier-1: e.g., it offers a 555 W bifacial module (~21.5% eff) and a 605 W bifacial (likely TOPCon ~22.8% eff). The company highlights its strict quality controls – low micro-crack rates, stringent EL screening, etc., given their magnetics business emphasis on precision. Warranty-wise, DMEGC provides typical 12-year product, 25-year performance for standard, and 30-year for dual-glass or n-type panels. The degradation rates they quote are industry standard (0.55%/yr for PERC, ~0.40%/yr for TOPCon). Notably, DMEGC has an in-house laboratory and has achieved certifications for global markets (TÜV, UL) to expand its reach.

Market Approach: Initially focused on the Chinese and some Asian markets, DMEGC has begun exporting more – in 2023 it started supplying to Europe in notable volumes and also to India and Brazil. Its strategy often is to partner with local distributors or project developers who seek a less “mainstream” brand with possibly better pricing but still Tier-1 quality. This has worked well as module oversupply made buyers more cost-conscious. Because DMEGC isn’t a household name, it tends to price slightly under top-brand modules. However, since it’s been profitable, it’s clear DMEGC isn’t engaging in the same race-to-bottom pricing; instead it likely keeps costs low through lean management and targets profitable segments (perhaps C&I projects, government tenders). Another aspect: Hengdian Group’s diversified businesses might open solar module sales channels – for example, if Hengdian supplies components to an electronics factory, they might bundle solar solutions for that factory’s roof. Looking ahead, DMEGC is expanding capacity cautiously to ~25–30 GW, ensuring it doesn’t overshoot demand. This prudence could maintain its profitability, at the expense of not grabbing headlines like the bigger expansions.

Strengths:

- Manufacturing Excellence: Coming from an electronics background, DMEGC has very high manufacturing precision and yield, resulting in reliable panels with fewer defects. Its solid fundamentals are reflected in being profitable where others lost money pv-tech.org.

- Focused Growth: DMEGC’s measured capacity expansion and focus on efficiency (both operational and cell tech) give it one of the better cost structures among second-tier players. This efficiency translates into competitive pricing without bleeding cash.

- Emerging Bankability: Recognition by S&P/PV-Tech and others as Tier-1/Tier-2 indicates banks and developers are gaining confidence in DMEGC. As its volumes grow and track record builds, it could become as bankable as the long-time incumbents.

Weaknesses:

- Lower Profile & Marketing: DMEGC lacks brand awareness in many markets. It doesn’t (yet) have the marketing presence or large international offices to directly support big developers, which can be a hurdle in winning marquee projects.

- Limited Upstream Capacity: Unlike some peers, DMEGC isn’t vertically integrated into polysilicon/wafer at scale, so it must source these. If the market tightens, DMEGC could be squeezed on input costs (though currently oversupply makes this a minor issue).

- Dependency on Few Key Markets: If a large portion of DMEGC’s sales are in a few regions (say domestic China and one or two overseas markets), it faces concentration risk. It will need to ensure it diversifies geographically to avoid being hurt by any regional policy changes or demand fluctuations.

DAS Solar

Overview: DAS Solar is a fast-rising newcomer in the Chinese solar scene, emblematic of the new generation of manufacturers. Founded in 2018 (Zhejiang, China), DAS Solar in just a few years has skyrocketed into the top 10. In H1 2024 it shipped 10 GW of modules sunsave.energy, an extraordinary feat for a ~5-year-old company. That pace likely continued or accelerated, putting DAS’s full-year 2024 shipments around 18–20 GW. The company has quickly expanded manufacturing across 14 factories in China sunsave.energy and even announced its first overseas plant – a 3 GW module factory in France (to open in 2024/25) as part of its global ambitions sunsave.energy. DAS Solar’s growth is driven by its focus on n-type technology and innovative products. It caught industry attention with novel offerings like lightweight panels and solar-integrated gadgets. Despite its youth, DAS is now commonly included in Tier-1 discussions; PV-Tech’s ratings placed DAS in the A category, noting it “offers high-quality products” albeit with less scale/financial muscle than the very largest 7sun.eu. The company’s rapid growth was helped by strong backing (it has ties to municipal government funding in China and strategic investors) and an entrepreneurial management that moves quickly. If it maintains momentum, DAS Solar could challenge some established players in coming years.

Innovation & Products: DAS Solar positions itself on cutting-edge technology. It produces both n-type TOPCon and p-type PERC modules, but has been particularly aggressive in n-type R&D. In H1 2024, its shipments were a mix of n-type and p-type monocrystalline panels sunsave.energy. One of DAS’s standout innovations is its ultra-lightweight solar panel: a module of standard dimensions but only 10.2 kg weight (roughly half of a typical panel) sunsave.energy. This 10.2 kg panel still achieves 475 W power with 20.8% efficiency sunsave.energy – making it ideal for rooftops with weight constraints or easier handling. Such a product differentiator shows DAS’s focus on niche needs. Additionally, DAS Solar has a creative consumer side: it developed solar backpacks (10–30 W portable panels built into backpacks) to charge gadgets on the go sunsave.energy. While not a huge revenue source, it signals an innovative culture. For mainstream modules, DAS offers full-black residential panels ~410 W (21% eff), bifacial dual-glass modules ~550 W (PERC) and ~580+ W (TOPCon). It’s also reportedly working on perovskite-silicon tandem cells, having achieved lab results above 29% efficiency, which could feed into future commercial products. In terms of reliability, being new means not much long-term field data yet, but DAS claims its modules pass all IEC durability tests and it provides standard 12/30 year warranties (with its n-type degradation ~0.4%/year).

Market and Strategy: Initially, DAS Solar capitalized on China’s domestic solar demand, but it’s clearly eyeing global markets (as evidenced by the planned French factory for European “local” supply). Entering Europe via local manufacturing also sidesteps the EU’s likely carbon tariffs and taps into the premium market for tariff-free Chinese panels. Globally, DAS will likely compete on a mix of high performance and attractive pricing. As a newer entrant, it has been pricing modules very competitively to win market share – often undercutting bigger brands slightly, while highlighting its TOPCon tech benefits. This approach helped it secure deals, for example, with some European distributors eager to try a new supplier with n-type panels slightly cheaper than JA/Trina. However, DAS must also build a bankability reputation; lenders will watch how its panels perform over a few years. The company is doing the right things: getting certifications, building service centers, and marketing its innovations. Its nimbleness could be an advantage – being smaller and privately driven, it can pivot faster to new tech or market demands than some giants. The risk, of course, is whether it can sustain rapid growth without operational hiccups or financial strain.

Strengths:

- Technological Agility: Quickly adopted n-type TOPCon and churns out innovative products (lightweight modules, etc.). DAS doesn’t carry legacy tech baggage, allowing it to leapfrog straight to the latest technologies in its facilities.

- Fast Growth & Ambition: Proven ability to scale from 0 to 20+ GW in a short time. Strong execution and ambitious global plans (e.g. EU factory) indicate a drive to become a major international player, not just a local upstart.

- Competitive Pricing (with Features): DAS can offer n-type panels with excellent specs at very attractive prices, often bundling features (lighter weight, etc.) that give it a selling edge in certain segments, rather than just competing purely on price per watt.

Weaknesses:

- Limited Track Record: With only a few years in operation, DAS lacks long-term field data on its panel reliability. Bankability is improving, but some conservative customers may be hesitant to switch from well-established brands until DAS proves itself over time.

- Financial/Operational Strain Potential: Hyper-growth can strain finances and supply chains. Scaling manufacturing while maintaining quality is a challenge – any slip in quality control could hurt its reputation early on. It also likely relies on external suppliers for wafers/cells (though it’s building some cell capacity), which could be a vulnerability.

- Dependence on Domestic Support: It’s rumored that DAS received local government support (common for new energy firms in China). If policies or support change, it would need to stand purely on its own. Also, its overseas expansion, like the French plant, will test its ability to operate in higher-cost environments.

Global Solar Panel Price Trends (2024–2025)

The solar industry has seen dramatic price swings recently. After a polysilicon shortage drove panel prices up in 2021–2022, the situation reversed in 2023–2024. A wave of new Chinese manufacturing capacity led to oversupply and a precipitous drop in module prices pv-tech.org. By late 2024, prices hit record lows: Chinese-made modules were being sold at 8–9 US cents per watt (FOB China) pv-magazine.com – levels unimaginable a few years prior. Even delivered prices to Europe were around €0.10/W (~$0.102) pv-magazine.com for Tier-1 TOPCon modules, reflecting weak demand and high inventory. This price crash squeezed all manufacturers’ margins (as seen in the losses many reported pv-tech.org), but greatly benefited project developers, who saw solar CAPEX costs fall.

In early 2025, China implemented measures (a “self-regulation” pact among manufacturers) to curb oversupply and stabilize prices pv-magazine.com. These helped slow the decline – module prices bottomed out and even ticked up slightly in Q2 2025. For instance, some producers attempted a modest $0.002–0.004/W increase in module prices in China after policy changes pv-tech.org. Additionally, a rush of installations in China (ahead of a subsidy policy cutoff in mid-2025) temporarily firmed up domestic prices pv-tech.org. Still, globally the market remains buyer-friendly. As of mid-2025, standard Tier-1 mono-PERC modules hovered around ~$0.17–0.20/W (utility-scale FOB Asia), while n-type TOPCon modules fetched ~$0.18–0.22/W – only a slight premium for ~1–2% better efficiency. In premium markets, prices diverge due to tariffs and shipping: delivered cost (DDP) for utility modules in the USA stayed about $0.28–0.30/W pv-magazine.com (because of import tariffs and freight), whereas in Europe DDP prices were closer to $0.11–0.15/W (depending on contract size and inclusion of 7.5% import duty).

Going forward, analysts expect module prices to remain relatively low through 2025, with a possible mild rebound if demand catches up to supply by 2026 pv-tech.org. For now, the abundance of Chinese capacity ensures that buyers have options: nearly all top Chinese brands are pricing aggressively to win share. This has led to a convergence in pricing – with Jinko, Trina, JA, LONGi, etc., often within 1–2 cents of each other on large deals – and puts pressure on second-tier makers to undercut further or differentiate via tech. One upside of the price war is that high-efficiency panels have become more affordable; for example, the latest n-type 580 W modules can be had at prices that were reserved for older 450 W models just 1–2 years ago.

However, ultra-low prices are not deemed sustainable long-term. Many manufacturers are running at slim margins or even below cost in 2024/25 pv-magazine.com. We’ve seen production cuts (operating at 50–70% capacity for many firms pv-magazine.com) to avoid a glut. The consensus is that weaker players may consolidate or exit, which could tighten supply and stabilize prices by late 2025. Until then, it’s a buyer’s market: globally averaged module prices in 2025 are the cheapest they’ve ever been, aiding solar’s competitiveness but posing a challenge for manufacturers to balance profitability with market share.

Global Pricing Snapshot (Late 2024):

- China Domestic: ~¥1.8–1.9 per watt (around $0.08–0.09/W) for bulk orders of monofacial mono modules pv-magazine.com. Slightly higher for N-type, but local competition kept prices minimal.

- Europe (CIF/DDP): ~€0.10–0.13/W ($0.11–0.14) for Tier-1 bifacial TOPCon modules pv-magazine.com. Spot deals occasionally even lower as sellers cleared inventory in Q4 2024.

- USA (DDP utility-scale): ~$0.28–0.32/W for utility mono PERC, ~$0.29–0.35 for TOPCon pv-magazine.com. Tariffs (Section 201, AD/CVD) and shipping add ~$0.15–0.20/W over Asian FOB prices.

- India & Emerging Markets: Many Chinese panels shipped to India at ~$0.20–0.22/W (no import duty for certain developers using cells from Southeast Asia). LATAM prices similar, around $0.20/W, often via traders.

- Residential Panel Retail: Homeowners don’t directly see these wholesale prices – retail panel prices remain higher due to distributor, logistics, and installer mark-ups. In the EU/US, a Tier-1 400 W panel might retail at ~$0.50–0.70/W (though this is falling too). Nonetheless, the trend of cheaper wholesale prices should eventually trickle down, reducing overall solar system costs worldwide.

Expert Insight: As Yana Hryshko of Wood Mackenzie noted, “Aggressive pricing, intense competition and continued capital investment [in new factories] weighed heavily on margins as companies pursued long-term leadership in market share and technology.” pv-tech.org In essence, 2024 turned into a survival-of-the-fittest “solar Hunger Games,” where only the most efficient, cost-effective manufacturers thrive. The top 10 Chinese panel makers covered above have so far proven they can navigate this turbulent market – by virtue of scale, innovation, or backing – and continue to drive solar’s global expansion at ever-lower prices.

Sources: Module manufacturer reports and press releases; BloombergNEF and PV-Tech rankings pv-magazine-usa.com, pv-tech.org; PV Magazine/OPIS price index pv-magazine.com, pv-magazine.com; Sunsave and Clean Energy Reviews for efficiency data cleanenergyreviews.info, sunsave.energy; Wood Mackenzie & PV-Tech expert commentary pv-tech.org, 7sun.eu. All linked references provide further detail on the performance, financials, and products of these solar industry leaders.